12 Things No One Tells You About Working In Real Estate

Congratulations! You’ve selected a highly rewarding, super lucrative, and totally fun career in the oh-so-cool field of… real estate. If you’re brand new to this

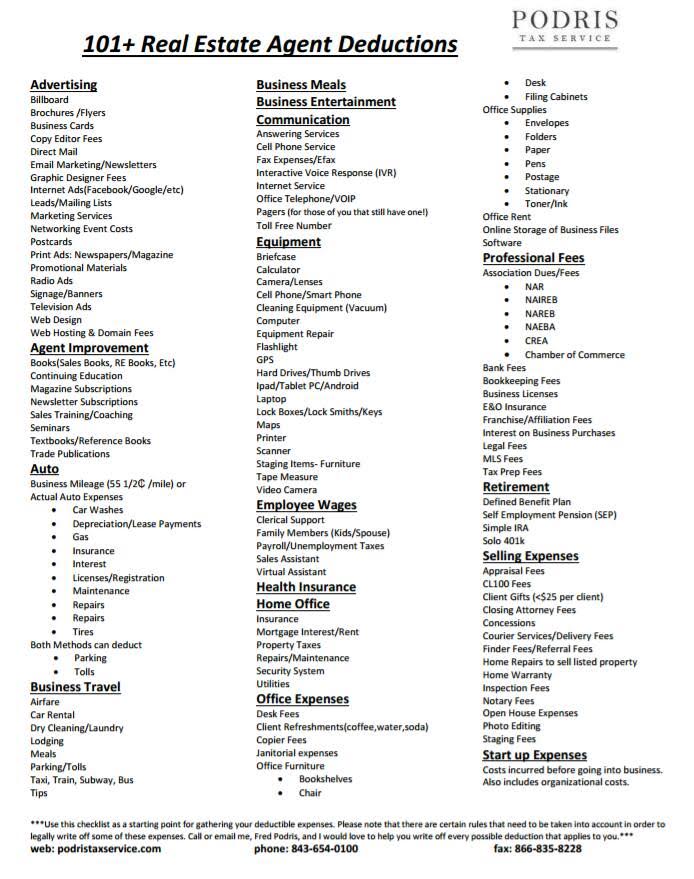

Real estate agents, who are by and large self-employed, can relate to the importance of tax deductions. By reducing your taxable income, deductions naturally become your best friend during tax time.

The problem, though, is determining what can be written off, and what can’t. It’s always best practice to consult your accountant, but a cheat sheet sure helps jog the memory so you don’t overlook anything you’re entitled to take.

Such a cheat sheet is exactly what’s below, thanks to two folks: 1) Fred Podris of Podris Tax Service who compiled the list, and REALTOR® Brenda Douglas who kindly posted it to Facebook for all to benefit from.

One problem, though. This cheat sheet, which was originally intended as a print-out, isn’t legible in digital format (see below). No worries, though. Just keep scrolling and you’ll see that we’ve transcribed it for easy reading.

Pin

Pin

(Disclaimer: We’re not a tax expert, and we don’t play one on the Internet. Consult your accountant for tax advice. What’s below is simply a list for quick reference.)

Advertising

- Billboards

- Brochures/Flyers

- Business Cards

- Copy Editor Fees

- Direct Mail

- Email Marketing and Newsletters

- Graphic Designer Fees

- Internet Ads (Google, Facebook, etc.)

- Leads/Mailing Lists

- Marketing Services

- Networking Event Costs

- Post Cards

- Print Ads (Newspapers and Magazines)

- Promotional Materials

- Radio Ads

- Signage/Banners

- Television Ads

- Web Design

- Web Hosting and Domain Fees

Agent Improvement

- Books (Sales Books, RE Books, etc.)

- Continuing Education

- Magazine Subscriptions

- Newsletter Subscriptions

- Sales Training/Coaching

- Seminars

- Textbooks/Reference Books

- Trade Publications

Auto

Either Business Mileage (55.5 cents per mile) Or… Auto Expenses

- Car Washes

- Depreciation/Lease Payments

- Gas

- Insurance

- Interest

- License/Registration

- Maintenance

- Repairs

- Tires

Both Methods can Deduct

- Car Washes

- Tires

Business Travel

- Airfare

- Car Rental

- Dry Cleaning/Laundry

- Lodging

- Meals

- Parking/Tolls

- Taxi, Train, Subway, Bus

- Tips

Business Meals / Entertainment / Communication

- Answering Services

- Cell Phone Service

- Fax Expenses/Efax

- Interactive Voice Response (IVR)

- Internet Service

- Office Telephone/VOIP

- Pagers (those still exist?)

- Toll Free Number

Equipment

- Briefcase

- Calculator

- Camera/Lenses

- Cellphone/Smartphone

- Cleaning Equipment (Vacuum Cleaner)

- Computer

- Equipment Repair

- Flashlight

- GPS

- Hard Drives/Thumb Drives

- Ipad/Tablet PC/Android

- Laptop

- Lock Boxes/Locksmiths/Keys

- Maps

- Printer

- Scanner

- Staging Items – Furniture

- Tape Measure

- Video Camera

Employee Wages

- Clerical Support

- Family Wages (kids/spouses… really)

- Payroll/Unemployment Taxes

- Sales Assistant

- Virtual Assistant

Health Insurance, Home Office

- Insurance

- Mortgage Interest/Rent

- Property Taxes

- Repairs/Maintenance

- Security System

- Utilities

Office Expenses

- Desk Fees

- Client Refreshments (Coffee, Water, etc.)

- Copier Fees

- Janitorial Services

- Office Furniture

- Bookshelves

- Chairs

- Desks

- Filing Cabinets

- Office Supplies

- Envelopes

- Folders

- Paper

- Pens

- Postage

- Stationary

- Toner/Ink

- Office Rent

- Online Storage of Business Files

- Software

Professional Fees

- Association Dues/Fees

- NAR

- NAIREB

- NAREB

- NAEBA (how many combos of those letters are there???)

- CREA

- Chamber of Commerce

- Bank Fees

- Bookkeeping Fees

- Business Licenses

- E & O Insurance

- Franchise/Affiliation Fees

- Interest on Business Purchases

- Legal Fees

- MLS Fees

- Tax Prep Fees

Retirement

- Defined Benefit Plan

- Self Employment Pension (SEP)

- Simple IRA

- Solo 401k

Selling Expenses

- Appraisal Fees

- CL100 Fees

- Client Gifts (<$25 per client)

- Closing Attorney Fees

- Concessions

- Courier Services/Delivery Fees

- Finder Fees/Referral Fees

- Home Repairs to sell listed property

- Home Warranty

- Inspection Fees

- Notary Fees

- Open House Expenses

- Photo Editing

- Staging Fees

Start Up Expenses

- Including organizational costs

(Shh, our secret)

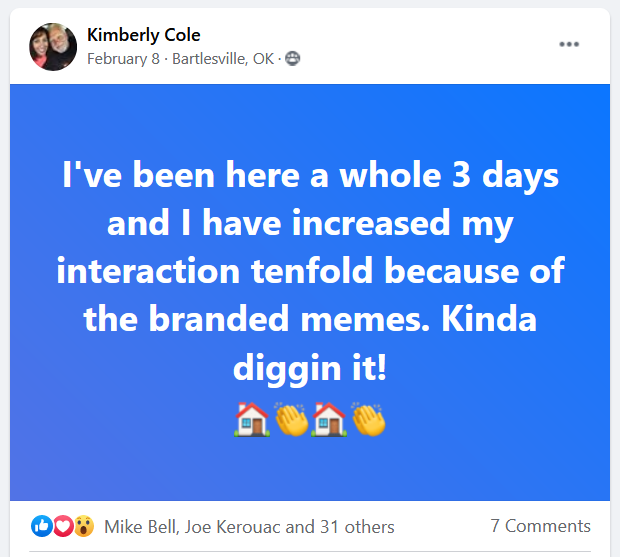

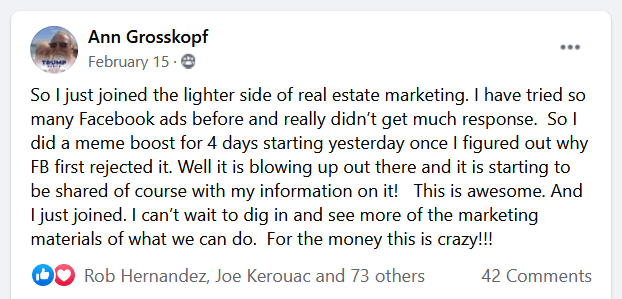

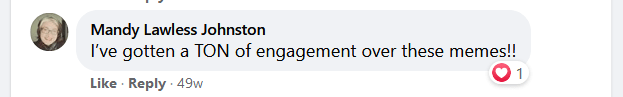

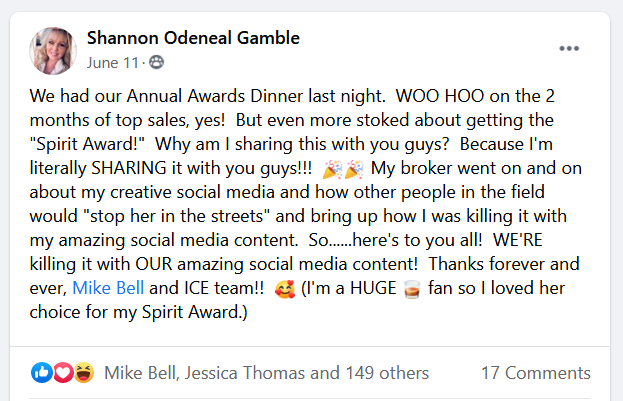

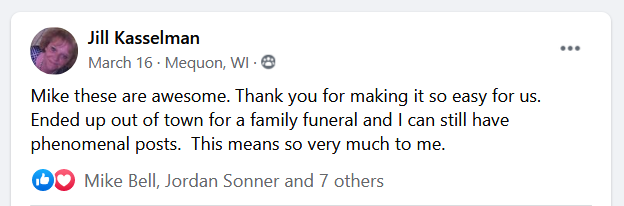

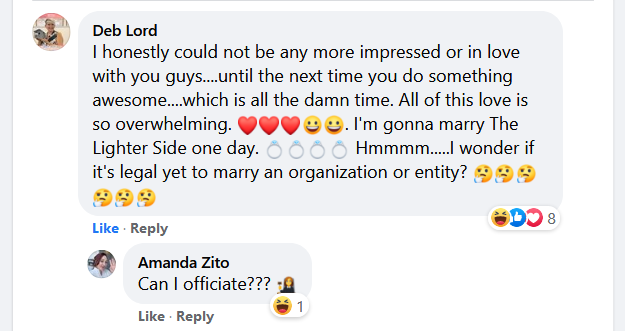

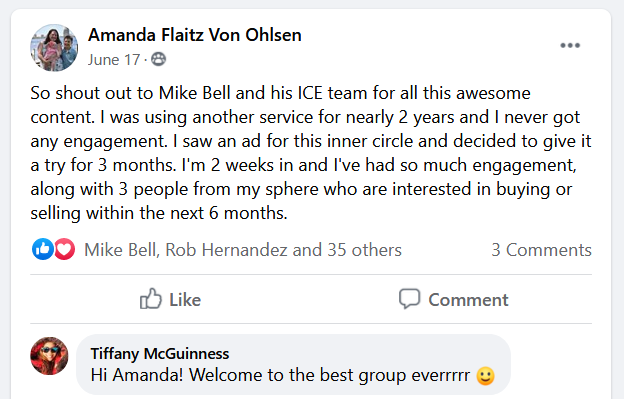

Show your sphere your an expert. We have over 2100 articles covering every real estate topic your audience will love.

Position yourself as a real estate authority!

Real estate + topical events — the perfect match!

Become the bearer of good vibes!

Because hey, everyone loves to laugh!

Get our weekly email that makes communicating with your sphere on social actually enjoyable. Stay informed and entertained, for free.

Congratulations! You’ve selected a highly rewarding, super lucrative, and totally fun career in the oh-so-cool field of… real estate. If you’re brand new to this

If you’ve been wondering if you can start out as a real estate agent part-time until you can get enough business to go full time,

There are some things that you don’t want to learn by mistake. Not that I haven’t made some of these mistakes myself. But if I

It hits you like a ton of bricks the first time you hear it could take months (or even years) for a real estate lead

Social media has become the go-to marketing tool for many agents—mainly because it’s free and already part of daily life. You’re already scrolling, so posting

Depending on your situation, it may not take the full 30 minutes.

This reset password link has expired. Check the latest email sent to you.