The Secret to Starting Part-Time Until You Can Become a Full-Time Real Estate Agent

If you’ve been wondering if you can start out as a real estate agent part-time until you can get enough business to go full time,

Many homebuyers have felt like they’ve had to go to extremes just to have their offers considered. For a while now, the combination of limited inventory, bidding wars, and competition from investors—ranging from local flippers to large hedge funds—has left everyday buyers feeling like they need to act fast and give up key protections just to have a shot at getting their offer accepted.

Waiving contingencies like inspections or appraisals became a common tactic, not necessarily because buyers wanted to—but because it sometimes felt like the only way to be seen on equal footing. If you’ve felt that pressure, you’re not alone. It’s been a tough environment to navigate.

In some areas, inventory is ticking upward, and some buyers are putting their searches on pause due to rising rates or economic uncertainty. So that may be starting to shift to a degree and give you more breathing room than there was even a few months ago.

But competition is still a reality in many markets, so a law recently proposed in Massachusetts might sound like the perfect solution to a buyer’s ears—it would prohibit sellers from accepting offers from a buyer who offers to waive their right to an inspection.

The idea is to prevent buyers from feeling pressured into waiving their right to an inspection. It’s a well-meaning effort—but the bill hasn’t passed yet, and even if it does, it would only apply in Massachusetts.

For most buyers right now, the competitive landscape hasn’t changed much. Which means the question still stands: what should you do if you don’t want to waive a home inspection—but you still want a shot at buying a home?

If you’re not comfortable waiving a home inspection (and let’s be honest, most buyers shouldn’t be), there are still strategic, effective ways to stand out—without putting your future homeownership at risk.

Think of it this way: waiving your inspection might save you money today, but it could cost you far more down the road if there are hidden problems with the home. By slightly increasing your offer—especially if it still aligns with recent comps—you may be able to preserve your contingency and stay in the running.

It’s not about blindly throwing money around. It’s about weighing short-term costs against long-term risks—and protecting your investment from surprises that could be far more expensive than an extra $5,000 on the offer.

Alternatively, you can include an “informational only” inspection in your offer. This gives you the right to inspect the home for your own knowledge, but not to renegotiate price or request repairs—though in some cases, you may still retain the right to cancel based on the findings. A good buyer’s agent can help clarify your options based on local norms.

It’s easy to get swept up in the competitive spirit and make decisions based on emotion. But once the dust settles and the keys are in your hand, you’re the one living with whatever issues the home may have. Waiving an inspection might help you win the bid, but it also means taking full responsibility for any repairs or surprises down the road.

Unless you’re financially prepared—or handy enough—to take on unknown repairs, it’s worth thinking twice. A major plumbing issue, foundation crack, or faulty electrical system can quickly turn your dream home into a costly nightmare.

That’s why most buyers benefit from having a great buyer’s agent in their corner.

Your agent can help you keep things in perspective, keep you calm amidst stiff competition, and help you craft and negotiate a strong offer even if you aren’t willing to waive your rights to a home inspection.

The Takeaway:

The pressure to move fast and compete with aggressive offers has caused many buyers to feel the need to waive their home inspection contingency. But there are ways to remain competitive while still making sure your future home is safe, solid, and worth the investment. Whether it’s choosing homes with less competition, structuring inspections creatively, or working with a trusted agent who can advocate for your needs—there’s no need to compromise your peace of mind.

(Shh, our secret)

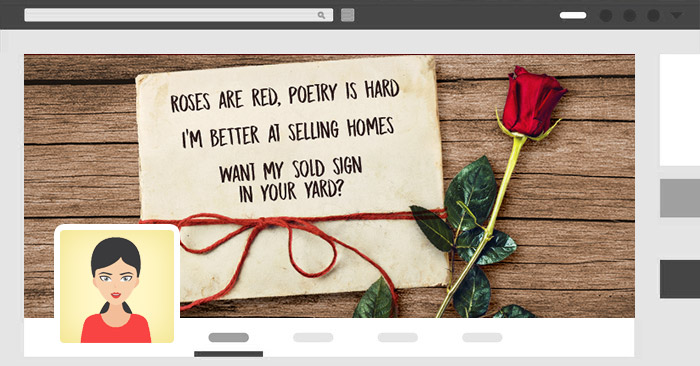

Show your sphere your an expert. We have over 2100 articles covering every real estate topic your audience will love.

Position yourself as a real estate authority!

Real estate + topical events — the perfect match!

Become the bearer of good vibes!

Because hey, everyone loves to laugh!

Get our weekly email that makes communicating with your sphere on social actually enjoyable. Stay informed and entertained, for free.

If you’ve been wondering if you can start out as a real estate agent part-time until you can get enough business to go full time,

In this spirit of transparency, we admit we’re totally biased when we say “the most clever.” Why’s that? Because we created them. At any rate,

As the Chief Chuckler in Charge of the Lighter Side, I believe I have the coolest job in the world. I wouldn’t trade it for

Every agent needs a lead list. They are compilations of prospects you can reach out to when you are trying to drum up business. They

At some point in their career, almost every agent either considers joining a team, or is asked to join one. It’s not the right move

Depending on your situation, it may not take the full 30 minutes.

This reset password link has expired. Check the latest email sent to you.