Take Your Word-Of-Mouth Real Estate Marketing to the Next Level by Teaming up with a Local Influencer

Most real estate agents use social media as a means of marketing themselves, at least to some degree. Some agents are able to build a

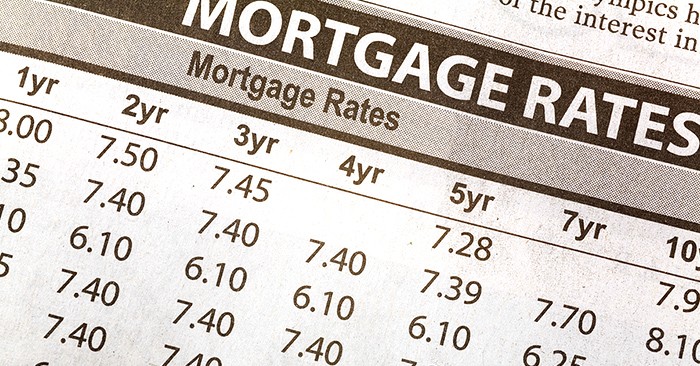

Typically it’s buyers who are most concerned about rising mortgage interest rates, and for good reason. A small jump in rates will cost them a few more bucks per month for the same house than it would’ve if they hadn’t waited to make an offer and lock in a rate. Add a few of those rate hikes together before they buy, and the added cost can be really aggravating.

Mortgage rates constantly go up and down, which is why they’re almost always in the news. It’s something to write about. Right now they happen to be going up again, as CNBC pointed out in this article about how rates jumped again and how it affects buyers. To summarize the big news, rates went up 0.35% in a week. Overall, not a huge deal. At least not enough to really change home values overnight.

But then they dig in a little more and added, “For a median-priced home, currently about $350,000, buyers putting down 20% will now see a monthly payment $125 higher than they would have just three weeks ago.” They’re going back three weeks to basically say that the monthly payment would be $125 more per month for the average buyer. That isn’t due to the one-week bump; that’s due to a few bumps over time. But it starts to add up, and buyers start to notice and feel it a little more.

Does this mean there’s going to be an absolute halt to the buying frenzy? No, at least not overnight. The market (and your home’s value) won’t turn on a dime and turn your dollars into dimes. But if the trend continues, and the news continues to point it out and alarm buyers, it could cause them to at least be less aggressive in how much they’re willing to pay in the near future. Or, perhaps they’ll just be less willing to get involved in a bidding war. Also worth noting: it could also come to a point, if rates rise significantly, where buyers simply won’t be willing to pay the prices they have been for a house.

After all, the value of homes is in large part based upon how much buyers can afford to pay per month, and what they want and will agree to buy for that much per month. So, if they get to a point where the rates are increasing their monthly payment too much, it will likely cause them to lower the amount they are willing to pay for your house.

There’s really no crystal ball to say whether or not rates are on an upward trend for good, or how high they’ll go. All you can deal with is the here and now, along with a little “what-if” assessing.

The Takeaway:

If you’re even remotely thinking about selling, here’s a good two-step game plan:

- Get a firm grasp on what your house is currently worth in the market right now.

- Assess whether or not it makes sense for you to capitalize on the current value and sell now, or let it ride and see if the rates keep hovering and values continue to rise (or at least stay about the same).

(Shh, our secret)

Show your sphere your an expert. We have over 2100 articles covering every real estate topic your audience will love.

Position yourself as a real estate authority!

Real estate + topical events — the perfect match!

Become the bearer of good vibes!

Because hey, everyone loves to laugh!

Get our weekly email that makes communicating with your sphere on social actually enjoyable. Stay informed and entertained, for free.

Most real estate agents use social media as a means of marketing themselves, at least to some degree. Some agents are able to build a

Open your inbox right now. Take a look. Go ahead. Chances are, it’s overwhelming. A wall of unread messages, combined with some that’ve been sitting

There’s no way around it… Now, more than ever, you’ve GOT to stand out as a real estate agent. To say our industry is over-saturated

Social media is a blessing and a curse for real estate agents. It has made it so much easier (and less costly) to stay in

Question: Have you seen the postcards most agents send out? BOOOR-ING! I’m pretty sure they make the prospects sleep-walk on their way back inside the

Depending on your situation, it may not take the full 30 minutes.

This reset password link has expired. Check the latest email sent to you.