The Ten Realtor Commandments: Rules To Live By

There are some things that you don’t want to learn by mistake. Not that I haven’t made some of these mistakes myself. But if I

With all of the news about mortgage rates going up, many potential homebuyers are wondering if they should be concerned. Should they hurry and buy now before rates go up more, or hold off and see if rates come back down?

Considering how much hype rates are getting, and the tone of the headlines, it makes sense to be concerned and question what you should do.

While there’s no one-size-fits-all answer, it might help to consider the bigger picture. Rates are still historically low, and they haven’t exactly skyrocketed. Sure they’ve gone up, and are the highest they’ve been in a few years, but they’re still low if you consider the data in this chart showing rates from 1971 to 2022.

It’s pretty common for people to refer back to the 1980’s when rates were double-digit in the high teens. It’s a good spin on the topic, but that’s not a great comparison. That was a totally different time and ages ago in terms of real estate. But if you look back to the early 2000’s through 2008, rates hovered around the 5-6% range. That’s a better comparison to make. Even with news of rates breaking the 4% mark recently, that’s still low compared to more recent times and market conditions.

The question is when and how much rates will go up, and will home prices come down accordingly? Unfortunately, there’s no crystal ball to answer that. You can only deal with what you know at the current moment.

But if you’re going to speculate on whether home prices will come down, consider that there’s still low inventory and high buyer demand. On top of that, rents are going up considerably, making buying more appealing than renting — a situation that attracts more potential buyers to the market. With little indication that supply will increase, coupled with increasing buyer demand, it’s less likely that prices will adjust down due to relatively small rate hikes. Rates would have to jump considerably more for that to happen.

The Takeaway:

By no means should you rush out and buy a house just to beat the rates. But if you are in the market for a new home, you should certainly be aware that rates are rising. Keep your eye on them, and make a concerted effort to buy sooner than later just to hedge your bet.

Make sure you work with a mortgage advisor who can keep you abreast of changes and advise you when (and whether) to lock in a rate, depending upon your situation.

Most importantly, know how much your monthly mortgage payment will be based upon the rates and the price range you’re buying in. If you’re comfortable with that, and can handle it on a monthly basis, then the rate shouldn’t affect you that much if you buy within your means. And if they do go down in the future, you can always refinance.

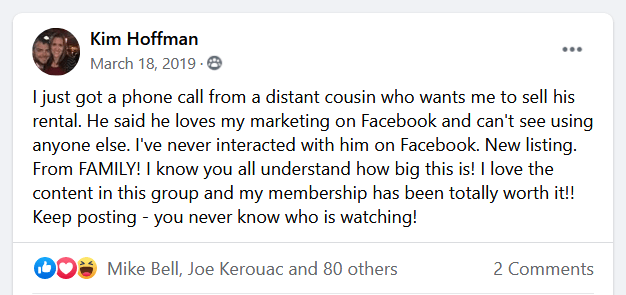

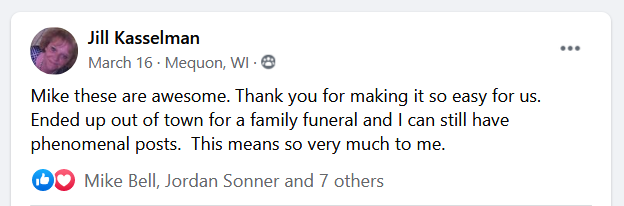

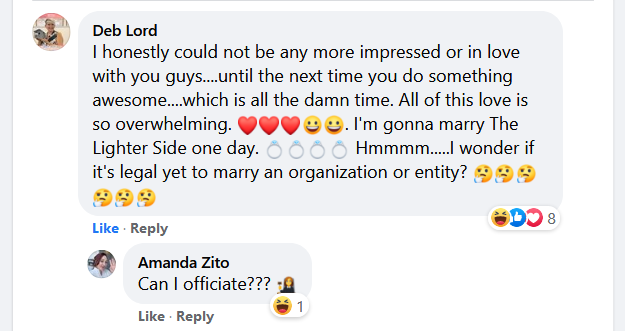

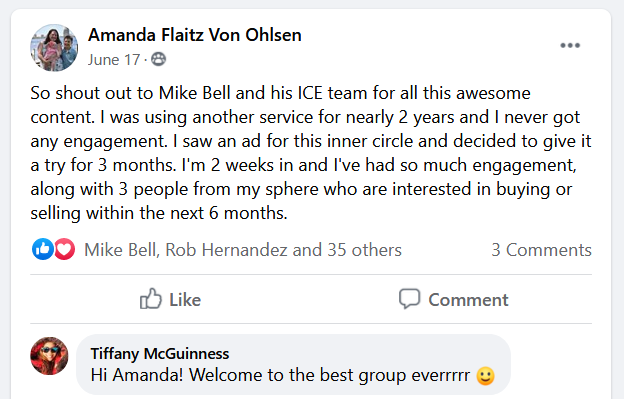

(Shh, our secret)

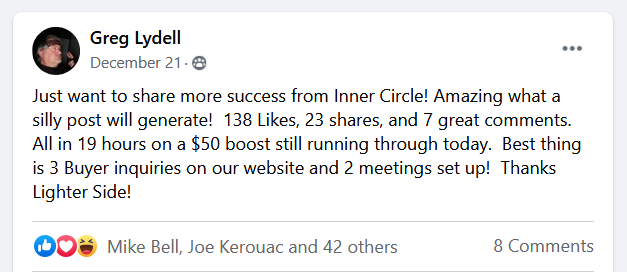

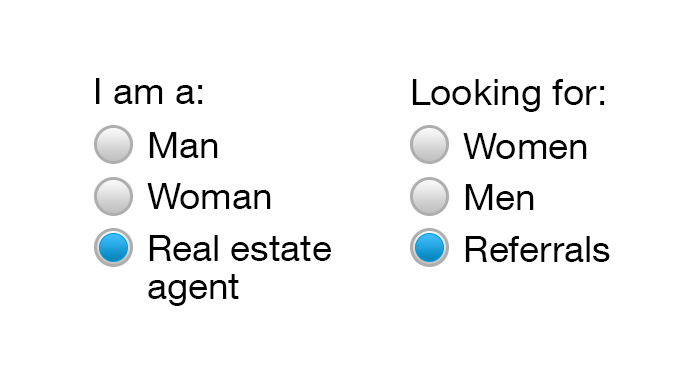

Show your sphere your an expert. We have over 2100 articles covering every real estate topic your audience will love.

Position yourself as a real estate authority!

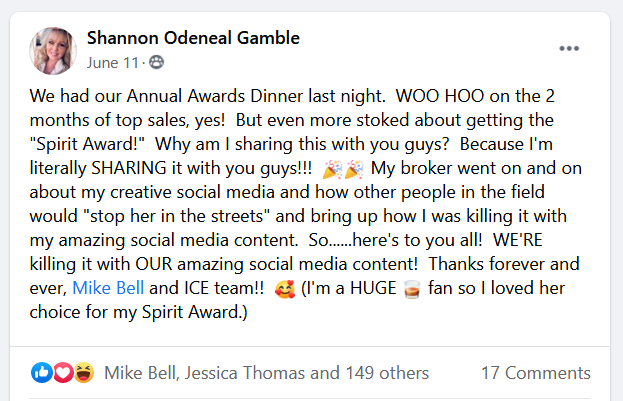

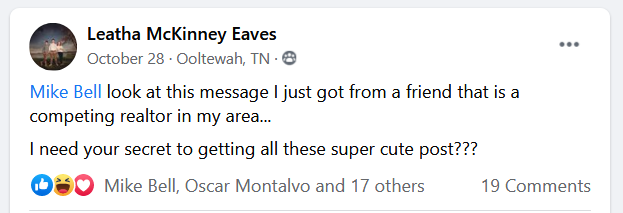

Real estate + topical events — the perfect match!

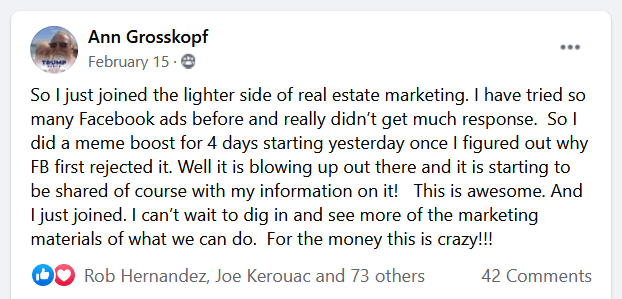

Become the bearer of good vibes!

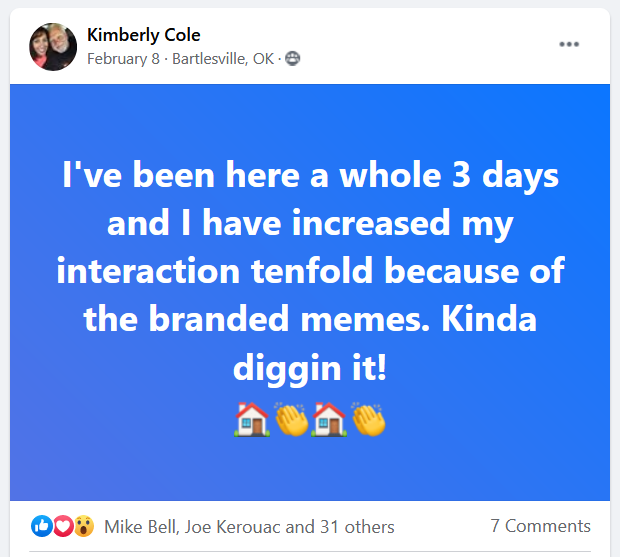

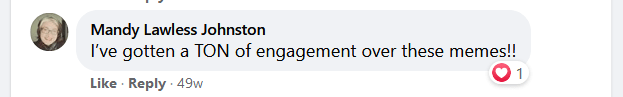

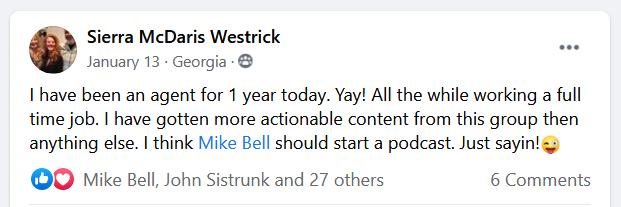

Because hey, everyone loves to laugh!

Get our weekly email that makes communicating with your sphere on social actually enjoyable. Stay informed and entertained, for free.

There are some things that you don’t want to learn by mistake. Not that I haven’t made some of these mistakes myself. But if I

There’s no way around it… Now, more than ever, you’ve GOT to stand out as a real estate agent. To say our industry is over-saturated

Question: Have you seen the postcards most agents send out? BOOOR-ING! I’m pretty sure they make the prospects sleep-walk on their way back inside the

First and foremost, no, this article wasn’t written using artificial intelligence. Or does that sound exactly like something AI would say to throw you off

Statistically speaking, the majority of real estate agents don’t make it beyond a couple of years, so don’t feel bad if you’re thinking about giving

Depending on your situation, it may not take the full 30 minutes.

This reset password link has expired. Check the latest email sent to you.