Why Real Estate Agents Should Always Brand In Stilettos

Crazy title for an article, right? I know. Stick with me, though. I promise this isn’t some sort of “clickbait.” There’s a powerful message if

Years ago, people expected to buy a “starter home” and live in it for a while, build up some equity, and then sell it and move up to a bigger house a time or two until they reached their final forever home.

But two things have made it difficult for first-time buyers to take that approach:

In other words, first-time buyers often feel they have to spend more money than they should for a house that isn’t even close to as nice as they aspire to live in. Champagne taste on a beer budget, as the saying goes.

This can cause a potential buyer to decide not to buy until prices come down, or until they somehow save up enough to afford a home they actually want. Unfortunately, waiting for prices to fall may not happen, or at least enough to make a huge dent in how much house they can afford. And saving up enough money faster than home prices rise is also difficult to achieve… unless you’re making money like Warren Buffett does.

Warren Buffett still lives in the same home he bought for $31,500 in Omaha, Nebraska back in 1958 — a fun fact you’ve probably heard many times. Granted, according to Yahoo, it’s now worth approximately $1,439,000 million. But the point is, he could certainly afford an even bigger, fancier home than that! (And he considers it one of his best investments, which says a lot since he’s considered one of the best investors in the world.)

But you might not have heard that his recently deceased business partner, Charlie Munger, also lived in a relatively modest home he’d owned for the past 70 years. In fact, CNBC recently reported that he claimed both he and Buffett made a conscious choice to not buy fancy houses. Their reasoning? Because they observed that buying more expensive homes made their rich friends less happy, rather than more happy.

Those are thoughts worth pondering for anyone who’s been considering buying a home, but has been putting it off because home prices are too high, or until they can afford something bigger and better than their budget currently allows.

It’s human nature for people to want more than they can afford. That’s not a new thing. But it’s probably gotten more difficult to be content with what you can buy today with social media posts from peers, influencers, TV shows, and movies making it seem like you should be able to live a life of luxury like so many people you see on your various screens humble-bragging about the way they live.

Seeing this constantly makes it easy to start wishing you earned more, could sell a body part you could live without, or just go deep into debt and hope you can somehow make the monthly payments.

What’s not typically depicted is whether those people are truly happy with what they have. They probably appear to be happy, but maintaining that lifestyle and image may be wreaking havoc on their happiness and contentment.

However, whether they’re happy or not isn’t even the point…

If you’re struggling with how high home prices are right now, you’re not alone. But first-time buyers almost always feel that prices are at all-time highs at whatever point in history they’re in. That’s for good reason: home prices historically go up over time. Do they take a dip at times? Of course. But decades from now, whatever price you paid for your home now will seem ridiculously low, so don’t worry about prices being “too high” right now.

And if you’re struggling with how nice of a home your dollar can buy, just remember that two billionaires who could afford much fancier houses than they owned opted to live in modest homes because they saw wealthy friends become less happy after buying fancy homes.

So instead of waiting for prices to fall, or to save up enough money to buy a better house than you can currently afford, find the best house your dollar can get you, buy it, and focus on the happiness (and eventual wealth) your first home can provide you for years to come.

The Takeaway:

It’s easy for first-time home buyers to fall into the trap of wanting a fancier home than they can afford, which can lead to them hoping and waiting for prices to fall, or to save up enough money to buy a better house.

But according to the observations of billionaire investor Charlie Munger, buying a nicer, more expensive house does not guarantee that you’ll be happier. In fact, he witnessed it make his wealthy friends less happy.

Buy what you can afford now, and decades from now you’ll likely see today’s prices as a bargain compared to what they are in the future.

(Shh, our secret)

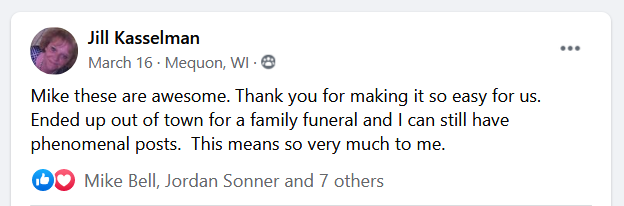

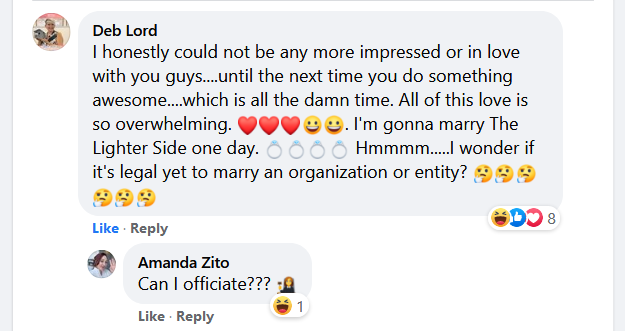

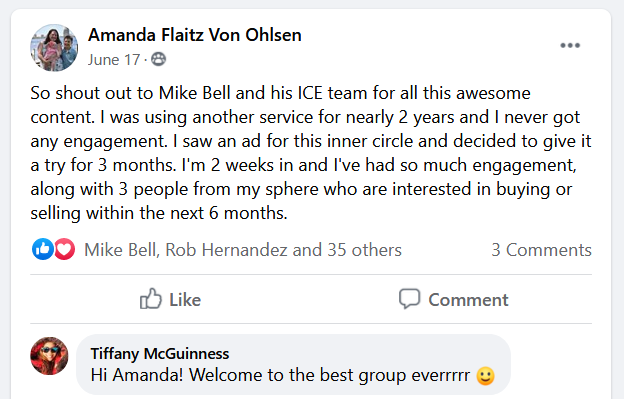

Show your sphere your an expert. We have over 2100 articles covering every real estate topic your audience will love.

Position yourself as a real estate authority!

Real estate + topical events — the perfect match!

Become the bearer of good vibes!

Because hey, everyone loves to laugh!

Get our weekly email that makes communicating with your sphere on social actually enjoyable. Stay informed and entertained, for free.

Crazy title for an article, right? I know. Stick with me, though. I promise this isn’t some sort of “clickbait.” There’s a powerful message if

(How to Become the Go-to Source for Local Reporters When They Need a Real Estate Expert) When you see someone quoted or interviewed by a

As much as the frantic pace of a “hot” market creates a lot of headlines and excitement, they’re not actually the best of times for

When you’re starting or growing a real estate biz, it seems like everyone has advice. Some advice is good, like, “Share interesting content consistently!” Some

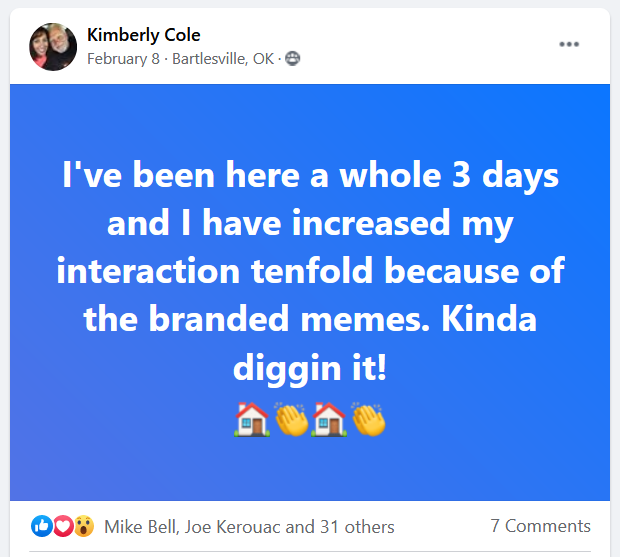

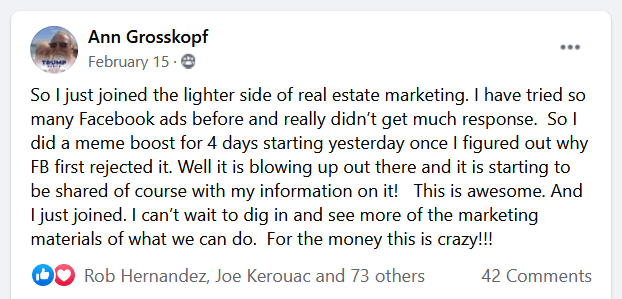

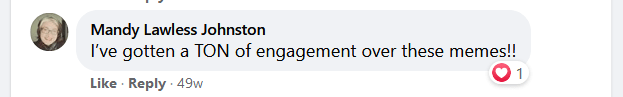

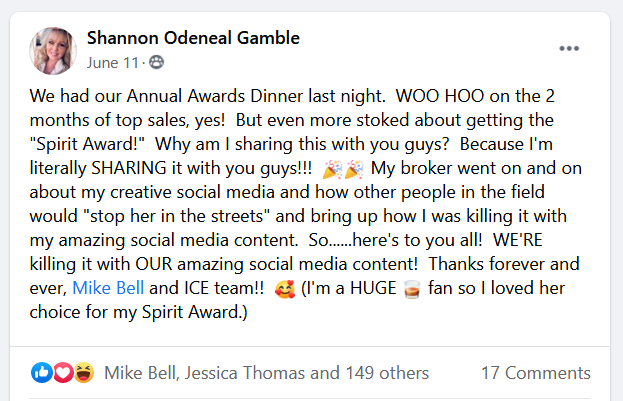

In this spirit of transparency, we admit we’re totally biased when we say “the most clever.” Why’s that? Because we created them. At any rate,

Depending on your situation, it may not take the full 30 minutes.

This reset password link has expired. Check the latest email sent to you.