5 Facebook Groups Every Real Estate Agent Should Know About

Oh, how being a real estate agent has changed over the years. It used to be that if you wanted to learn something, get another

There’s a saying in real estate: “Date the rate, marry the house.” But lately, some buyers aren’t even swiping right unless the rate starts with a two.

A new Real Estate News survey reveals that 1 in 4 would-be buyers say they’re sitting out until mortgage rates drop below 3%. Not 5%. Not even 4%. Three. The kind of rates economists are calling “very unlikely” in the foreseeable future.

Now, if you’re a buyer who’s actually in the market right now—or thinking about jumping in—it’s easy to wonder if rates should be lower or whether waiting might be the smarter move.

But consider this: that 25% of would-be buyers sitting on the sidelines is what makes it a good time for you to jump in.

And it may not last.

For a while, mortgage rates that started with a “2” or “3” weren’t just possible, they were common. So it’s understandable that some buyers now see anything higher as unfair or unreasonable. But just because something was normal for a brief moment in history doesn’t mean it was ever sustainable.

In fact, NAR Chief Economist Lawrence Yun offered a straightforward take: “Are we going to go back to 4% mortgage rates? Well, my forecast, unfortunately, is no. I think the new normal will be a 6% mortgage rate.” That’s not a prediction meant to discourage you—it’s one meant to ground you.

Sure, rates could dip slightly in the future. But if they do, it might be because of broader economic trouble, not because everything’s suddenly back to “normal.” Hoping for 3% again isn’t a strategy—it’s a stall.

Buyers who make peace with today’s rates are already ahead of the game. They’re not waiting for the stars to align. They’re out there shopping while others sit and hope for a time machine.

Coming to terms with today’s mortgage rates isn’t just about adjusting your expectations—it’s about recognizing the hidden advantages that come with this new landscape. One of the biggest? Fewer buyers are out there competing with you.

Sure, some markets are still moving quickly. Well-priced homes in desirable neighborhoods can still attract multiple offers. But in some areas, the pace has noticeably slowed.

Fewer buyers in the mix means:

It’s not 2021 anymore. But that’s not a bad thing.

Whether it’s a full-on cooldown or just a little breathing room, a dip in competition can work in your favor no matter what your market is like.

Unfortunately, while many buyers claim they’re holding out for 3%, behavior doesn’t always match beliefs.

If mortgage rates dip even modestly—say, into the mid-5s—a large chunk of these buyers who are waiting for rates to drop drastically could suddenly decide that’s appealing enough and jump back in.

So while it feels calmer now, this could just be the eye of the storm. A temporary window of lower competition that slams shut once rates drop even a little bit.

Wait too long, and you might miss the moment entirely. There likely won’t be a big flashing sign that says, “Competition is about to heat up.” It’ll just happen. Rates dip, more buyers reappear, and suddenly you’re back in a crowded market where flexibility disappears and prices start to climb.

The mortgage rate you lock in today doesn’t have to be your “forever rate.” If rates come down in the future, you can refinance, lower your monthly payment, and potentially gain even more equity as home values climb with renewed buyer demand. You didn’t miss out; you got in before the next wave.

No, it won’t happen overnight. But it’s an option down the road, and a good one.

On the other hand, the house you’ve been eyeing up might not still be available by the time rates drop. Neither will today’s calmer market or the seller who’s willing to negotiate. The real loss won’t be the rate—it’ll be the opportunity you waited just a little too long to take.

The buyers who say, “I’m going to wait for 3%” are a bit like someone saying, “I’ll go on a date once I meet the perfect person.” The idea sounds nice, but perfection rarely shows up in real life, and waiting for it can leave you with nothing but missed opportunities.

The successful buyer is the one who looks at today’s numbers, today’s market conditions, and says: “Does buying make sense for me now?”

If it does, go for it. If not, that’s okay—just don’t let idealized rates or what-ifs keep you from a very real opportunity.

Because the buyers you’re not competing with today will eventually be back. And when they return, you’ll be glad you didn’t wait for the “perfect moment” to swoop in.

The Takeaway:

Waiting for mortgage rates to drop back to 3% might feel like a smart move, but it’s largely wishful thinking. Not only are experts calling that rate unrealistic anytime soon, but waiting for it could also mean missing the advantages of today’s market. With fewer buyers actively shopping, there’s less competition, more negotiating power, and a better chance to buy a home on your terms.

If rates dip even slightly, sidelined buyers may flood back in, reigniting bidding wars and pushing prices higher. Instead of holding out for a rate that may never return, smart buyers are asking themselves if the current market conditions make sense for them—and acting accordingly. Because mortgage rates can be refinanced, but missed opportunities can’t be reclaimed.

(Shh, our secret)

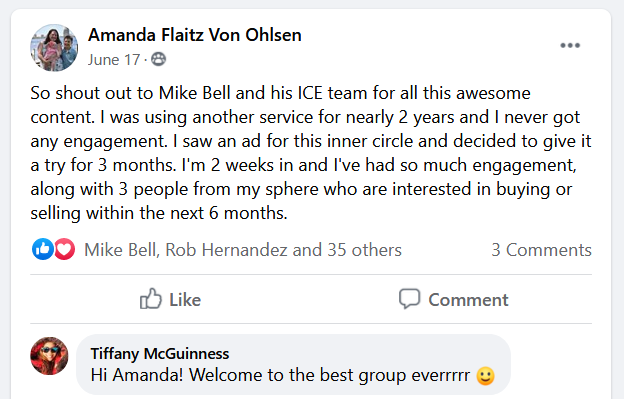

Show your sphere your an expert. We have over 2100 articles covering every real estate topic your audience will love.

Position yourself as a real estate authority!

Real estate + topical events — the perfect match!

Become the bearer of good vibes!

Because hey, everyone loves to laugh!

Get our weekly email that makes communicating with your sphere on social actually enjoyable. Stay informed and entertained, for free.

Oh, how being a real estate agent has changed over the years. It used to be that if you wanted to learn something, get another

Whether you’re a real estate agent looking for that perfect closing gift for your client, or just someone wanting to create something unique, you’ll want

As the saying goes, you shouldn’t judge a book by its cover. But when you’re hiring a real estate agent, it can be easy to

Crazy title for an article, right? I know. Stick with me, though. I promise this isn’t some sort of “clickbait.” There’s a powerful message if

“Let me know if you or anyone you know is thinking about buying or selling a house in the near future!” Sound familiar? Even if

Depending on your situation, it may not take the full 30 minutes.

This reset password link has expired. Check the latest email sent to you.