How To Get Other Agents To Drink Your “Kool-Aid”

Let me take a stab in the dark here… You feel your company is the greatest, and everyone else should join too. Am I right?

Your home is probably your largest asset and one of the biggest investments you’ll ever make. If you’re the parent of a student who’ll be heading off to college in the near future, you may be wondering about how to use your home to invest in your child’s future by helping pay that sky-high tuition.

Here are three ways you may want to consider using the equity in your home to do so.

There are multiple ways to borrow against your home’s equity. The first is a straightforward home equity loan, which is a second mortgage on your home. You’ll receive the full amount of the loan upfront and then begin paying it back over time with interest.

As you’ve been paying your mortgage, you’ve been building up equity. For example, if your mortgage was originally $300,000 but is now down to $200,000, your home equity equals $100,000, which you might be able to borrow against in the form of a loan.

Depending on the lender, you might be able to borrow as much as 80 to 90 percent of your equity, which means in the case of our example, you’d have possibly $80,000 to $90,000 at your disposal.

Another option is a home equity line of credit (HELOC). Much like a credit card, you have a maximum amount you can borrow up to as needed.

Whatever amount you choose to borrow, that’s the figure you’ll pay interest on. So, if your line of credit extends up to $90,000, but choose to only borrow $20,000, you’ll only pay interest on that amount, until you pay it down.

Another way to use your home to get your hands on much-needed funds is to refinance your current mortgage loan, replacing it with a larger mortgage loan. You can take the difference between the two loan amounts and spend it as you wish. This is called a cash-out refinance.

Again, you will likely only be able to take out a loan for 80 to 90 percent of the value of your home, so the difference you can keep will be based upon that. So, let’s say you have a home worth $300,000, and you only owe $100,000 on your current mortgage, you might be able to get a new mortgage against your house for somewhere between $240,000 to $270,000. After you pay off the original mortgage, you’d have $140,000 to $170,000 to work with.

This can be an especially good option if your current mortgage is at a higher interest rate than the current rates being offered.

Of course, your home is not the only source of money to pay for college tuition, but it does offer you some alternatives. Perhaps one of these three is a perfect fit for you. With that said, everyone’s situation and finances are different. So, before using your home equity make sure you consider all of the options available to you and your child.

(Shh, our secret)

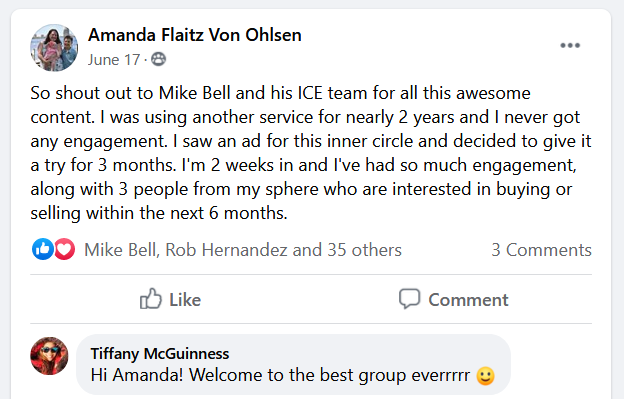

Show your sphere your an expert. We have over 2100 articles covering every real estate topic your audience will love.

Position yourself as a real estate authority!

Real estate + topical events — the perfect match!

Become the bearer of good vibes!

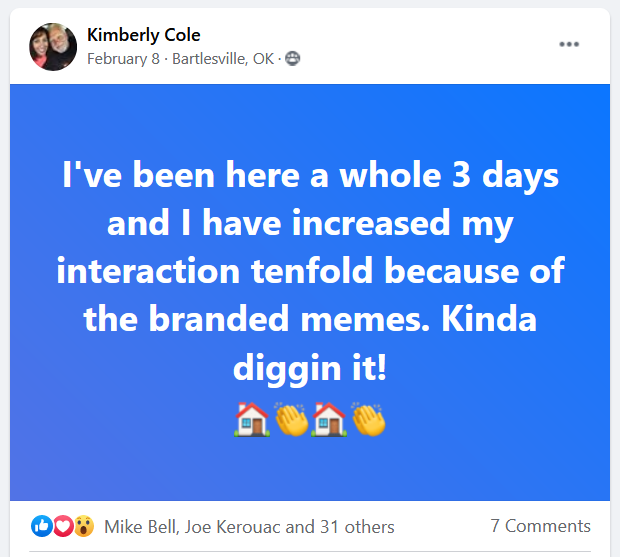

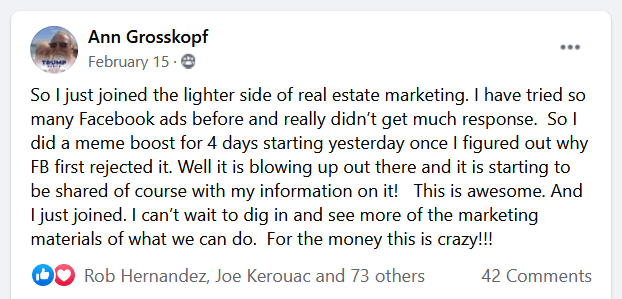

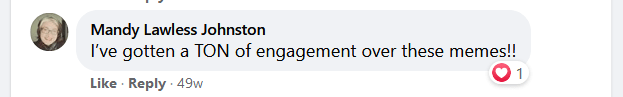

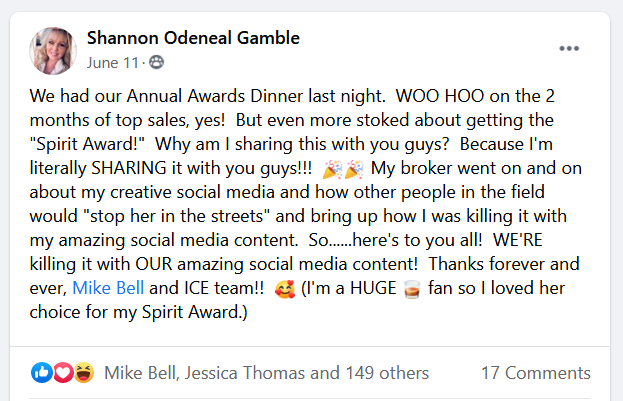

Because hey, everyone loves to laugh!

Get our weekly email that makes communicating with your sphere on social actually enjoyable. Stay informed and entertained, for free.

Let me take a stab in the dark here… You feel your company is the greatest, and everyone else should join too. Am I right?

Agents learn early on in their career that listings are the name of the game. Unfortunately, no matter how much sense that makes, it’s still

As the saying goes, you shouldn’t judge a book by its cover. But when you’re hiring a real estate agent, it can be easy to

As much as the frantic pace of a “hot” market creates a lot of headlines and excitement, they’re not actually the best of times for

The Meme-Worthy Truth About Why Personal Content Beats Perfect Content You spent 45 minutes designing the perfect “Just Listed” graphic in Canva. Bold fonts. Professional

Depending on your situation, it may not take the full 30 minutes.

This reset password link has expired. Check the latest email sent to you.