7 Clever Postcard Ideas For Halloween

Question: Have you seen the postcards most agents send out? BOOOR-ING! I’m pretty sure they make the prospects sleep-walk on their way back inside the

If you’re a renter—or planning to become one in the near future—you’ve probably noticed that rents are high. That’s no surprise, especially with housing markets booming and the cost of living rising.

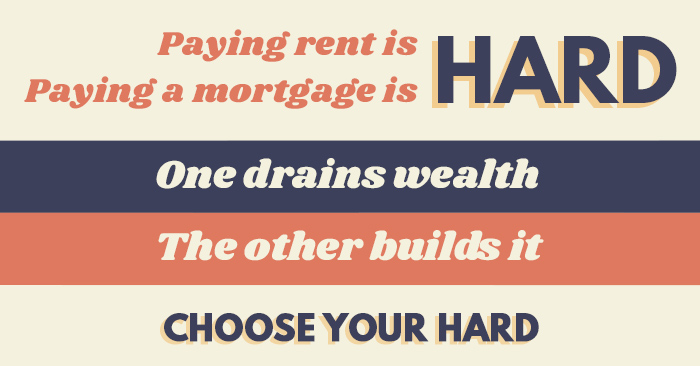

For many people, renting often feels more affordable than buying a place of their own, even if it comes with the sting of watching a significant chunk of their paycheck disappear every month.

But here’s a question: Have you ever paused to consider just how much you’ll pay in rent in your lifetime?

It’s probably not something you want to think about, but understanding the bigger picture of your rental expenses could be a game-changer, potentially saving you both time and money in the long run.

According to a study done by Self Financial, the average American will spend a staggering $333,065 on rent and related expenses over their lifetime. That’s roughly $25,620 per year from age 22 to 35. This figure includes about $241,303 in rent payments alone, with another $68,074 spent on utilities, and $12,145 on moving costs.

Of course, these numbers can vary widely depending on where you live. For example, if you’re renting in Hawaii, you could be looking at a lifetime rental cost of $599,242, or $46,096 per year, which is the highest in the U.S.

But it’s not just about geography. The study factored in that renters often move every couple of years, don’t recover about 25% of their security deposits, and spend a considerable amount on furnishings — some of which might be unnecessary or extravagant.

Now, before you start panicking at the thought of handing over a small fortune to a landlord over the years, let’s talk strategy. Here are 4 ways to minimize how much you spend on rent in your lifetime:

The reality is, a lot of young adults also find themselves eventually moving back home to live with family anyway, due to financial reasons. The good news is, according to a recent survey, 85% of parents are thrilled to have their adult kids move back home!

So, consider just living with your family for as long as possible, and make an effort to save money until you can afford to buy a place of your own, and avoid renting altogether.

Landlords can’t just keep your security deposit for no good reason, or even normal wear and tear, but they can certainly keep some of your deposit if you damage their property. If you give your landlord no reason to keep your deposit, this can add to your net savings over time.

Renting a place to live for at least some period of time in life is unavoidable for many people, and some people spend their entire life renting. There’s absolutely nothing wrong with renting. But if you want to buy a home in the future, every year you spend renting nips away at the money you could be saving toward a down payment.

Hopefully just being aware of how much money gets spent on rent by the average person will give you enough motivation to put some of these tips into action, and cut down on how much you spend on rent, no matter how long you’re a renter!

The Takeaway:

Renting can drain a significant chunk of your paycheck over your lifetime, with the average American spending over $333,000 on rent and related expenses.

To cut down on these costs, consider staying with family longer, or at least minimizing the number of moves you make, avoiding damage to your rental, and furnishing frugally, if you do rent.

Or, turn the equation around entirely and become a landlord! Buying a multi-unit house, or a single-family home with extra space you can rent out, could not only save you from spending hundreds of thousands on rent in your lifetime, it could make you money instead.

(Shh, our secret)

Show your sphere your an expert. We have over 2100 articles covering every real estate topic your audience will love.

Position yourself as a real estate authority!

Real estate + topical events — the perfect match!

Become the bearer of good vibes!

Because hey, everyone loves to laugh!

Get our weekly email that makes communicating with your sphere on social actually enjoyable. Stay informed and entertained, for free.

Question: Have you seen the postcards most agents send out? BOOOR-ING! I’m pretty sure they make the prospects sleep-walk on their way back inside the

The Internet has really leveled the playing field for real estate agents. Years ago you needed a hefty marketing budget to be able to get

It hits you like a ton of bricks the first time you hear it could take months (or even years) for a real estate lead

Hey there, Real Estate friend – I know Facebook can really burn your biscuits, but… Don’t throw in the towel just yet. Your business page

FACT: Your ability to attract clients has less to do with your “credentials”… and everything to do with how people feel about you. As a

Depending on your situation, it may not take the full 30 minutes.

This reset password link has expired. Check the latest email sent to you.