A recent Gallup Poll revealed that Americans at all income levels consider real estate the best investment you can make — over stocks, gold, savings accounts, bonds, or cryptocurrency. And it doesn’t seem to be just due to the fact that home values are at all-time highs.

They’ve been doing these surveys since 2002, and real estate has topped the list every year since 2014. Real estate was often the top choice in the previous years, too, with people only truly wavering from that opinion during the Great Recession years of 2008 to 2010 when home prices were down for a period of time.

If you already own real estate, this probably has you nodding your head in agreement. It’s easy for people who own real estate to feel that way.

But if you’re a renter, or still living at home with family, it might make you feel annoyed. You might very well agree that real estate is a great investment, but that doesn’t make it something you can easily invest in.

It’s Not as Easy to Invest in Real Estate as It Is in Stocks

Just because it’s seen as a great investment, that doesn’t make it an easy one for many people to make. Almost anyone can invest in stocks or mutual funds, even if they don’t have a lot of money set aside, since there are many price points and options to choose from in the stock market. You can find something to invest in on almost any budget, and you don’t have to buy stocks every month if your budget is tight.

On the other hand, investing in real estate does take having enough money saved for a down payment and closing costs, and the ability to pay your mortgage on a monthly basis, whether your budget is tight or not.

In addition, stocks are plentiful. You probably aren’t going to have trouble finding a stock to buy in any given price range. But real estate, especially right now, is significantly affected by supply and demand. There are only so many houses for sale in any area and any given price range. This not only makes real estate pricier, but also more difficult to successfully buy.

It’s Also Not “Just” an Investment for Most People…

Another aspect that makes investing in real estate more difficult for many people is that they aren’t just investing their money, they’re also looking at it as buying a place to live in and call home.

People don’t have to like the location of a company, or what their logo looks like in order to invest in it. But with real estate, many people care an awful lot about where the house is located, what style it is, what size it is, and how nice (or not) it looks. This further impacts how many options people will consider buying in the real estate market.

There’s absolutely nothing wrong with caring about where you live, or having a wishlist of things you want in a home. Everybody wants as nice of a location and house as possible to call home. It’s an extension of who you are, and often a source of pride and identity.

But waiting until you can buy a house that meets your wants and needs may be causing you to lose out on precious years of investment gains, which could ultimately help you buy the house you truly want.

“Rentvesting” Might Be Your Ticket to Homeownership!

People live where they live for a variety of reasons — like being close to work or family — which usually impacts where they might consider buying a house.

So, if there aren’t any houses for sale that meet your budget or criteria within a reasonable area around where you want to live, or there’s too much competition and it’s difficult to successfully buy one, there’s a good chance you might choose to just continue renting, or living with family.

If that’s the situation you find yourself in, but you want to start reaping the benefits of investing in real estate, you might consider “rentvesting,” which is a trend growing in popularity according to this realtor.com article.

Rentvesting is a term used to describe when someone continues to rent in the area they currently live in, which is often pricier or more difficult to buy a property in, and buying a property in a more affordable area that they rent out. Just because you rent the home you live in, that doesn’t mean you can’t start your journey into homeownership by buying a place you won’t live in!

If buying a home in an area you want (or need!) to live in isn’t affordable or achievable due to stiff competition or a lack of supply, look into buying an investment property in an area where there isn’t as much competition, and prices are lower.

While it may not be the traditional path to homeownership, it’s certainly better than trying to save enough money to be able to buy property in the area you currently live while renting. It’s difficult to outpace the market unless you’re in the market. Putting yourself in a position to reap the benefits of appreciation, rental income, and equity built as your mortgage is paid down using your tenants’ money is a great way to improve your ability to buy the home you truly want in the future.

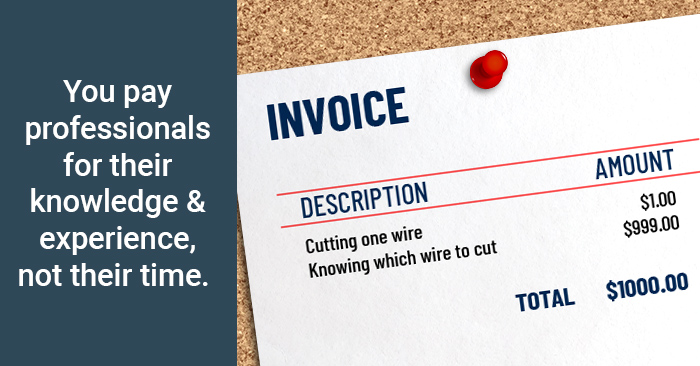

If this sounds appealing to you, research some areas that appeal to you, or ask your favorite real estate agent for their suggestions. Agents will not only be glad to help you discover potential areas, but also the best agents in that area to help you navigate the search and purchase process, as well as potentially managing the property if it is too far for you to manage yourself.

The Takeaway:

A recent poll shows that Americans across all income levels view real estate as the best investment, outpacing stocks, gold, savings accounts, bonds, and cryptocurrency.

While stocks are accessible to nearly everyone, investing in real estate typically requires more savings, and comes with more supply and demand challenges, which makes it more difficult to invest in than other options. But another issue for many people is that they’re often focused on buying a home that fits their personal wants and needs, rather than looking at it as purely investment, which can lead to them continuing to rent because they can’t afford to buy what they truly want in a home.

For those unable to buy a home in an area where they want or need to live, “rentvesting” might be worth considering. This is a growing trend where you continue renting in your current location, while buying an investment property in a more affordable area. This approach allows you to benefit from real estate investments without waiting to buy a home in a high-demand area.