5 Things That Don’t Matter as Much as You Might Think When Hiring a Real Estate Agent

As the saying goes, you shouldn’t judge a book by its cover. But when you’re hiring a real estate agent, it can be easy to

If you’re a renter and live alone, it’s no surprise that it costs you more than if you had a significant other, or at least a roommate, to help pay the rent. But have you ever done the math on exactly how much extra it costs you?

According to this Business Insider article, it costs a single person an average of $7,000 more in rent per year than people with a partner or roommate.

The obvious solution to avoid this “singles tax” is to find yourself a significant other, or a roomie. But if you live alone, there’s probably a reason why you haven’t already gone either of those routes, like:

But there is a solution which may not only lower the amount you pay in “singles tax,” but will also give you tax breaks! If you play your cards right, it could even cost you less out of pocket than your current rent, or (gasp) even make you money every month…

Buying a rental property with more than one apartment could afford you the luxury of living in your own apartment, while renting out the others.

While not everyone who rents can qualify to buy a place, many renters often simply think they wouldn’t be able to, and don’t even look into the possibilities. Rather than just presuming you’re stuck having to pay the “singles tax” until you find the love of your life (or at least a roomie), why not look into whether or not you can buy a rental property? Interested? Here’s how to go about it:

The so-called “singles tax” costs $7,000 on average, but depending on where you live that amount could be less, or even more per year. Regardless of how much more it costs you to live alone, it’s not a bad idea to look into buying an income-producing property… because if you’re going to pay rent, it might as well be to yourself!

The Takeaway:

A recent analysis revealed that rent is costing single people living alone a “singles tax” of $7,000 more per year on average, than their peers who live with a significant other or roommate. A good way to try and lower that out-of-pocket amount, or even turn a profit, is to buy a rental property and live in one apartment, while renting out the others.

(Shh, our secret)

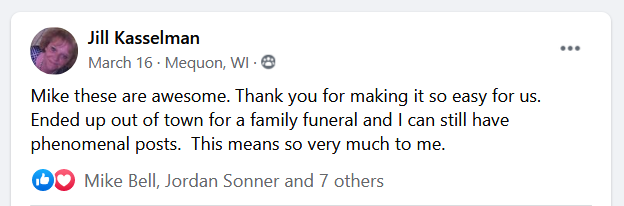

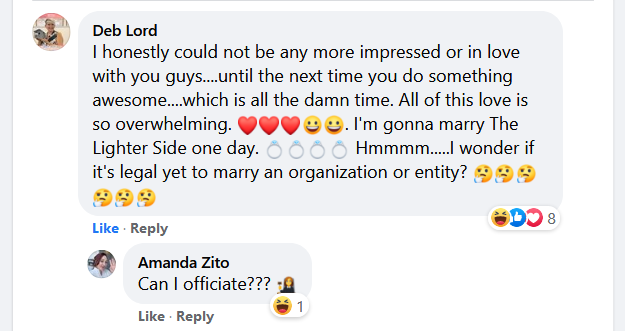

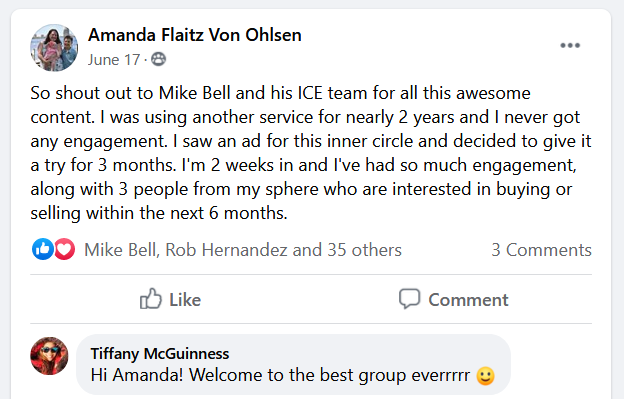

Show your sphere your an expert. We have over 2100 articles covering every real estate topic your audience will love.

Position yourself as a real estate authority!

Real estate + topical events — the perfect match!

Become the bearer of good vibes!

Because hey, everyone loves to laugh!

Get our weekly email that makes communicating with your sphere on social actually enjoyable. Stay informed and entertained, for free.

As the saying goes, you shouldn’t judge a book by its cover. But when you’re hiring a real estate agent, it can be easy to

“Normal” people often ask me, “Cathy, could I make it if I’m not genetically predisposed to being a Realtor as you were?” Heredity did play

There’s probably an agent in your area whose face seems to be plastered everywhere you look. You’re driving down the road and, boom, you see

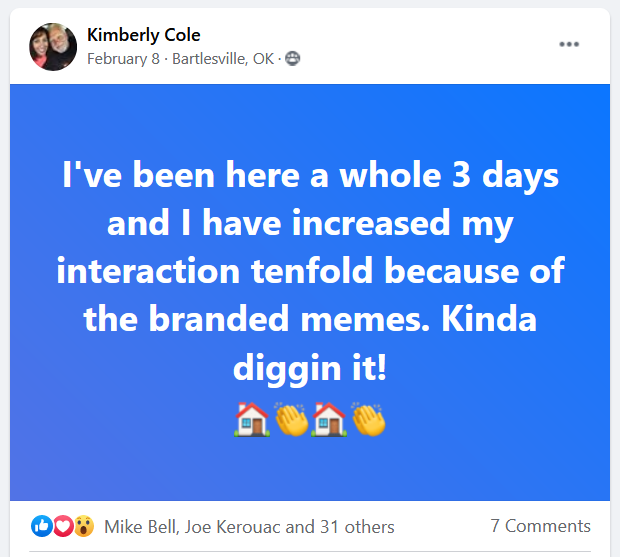

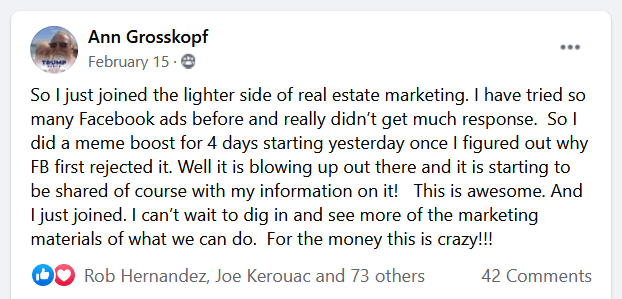

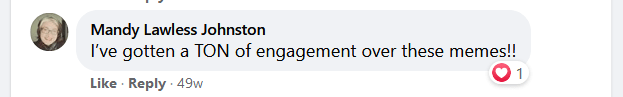

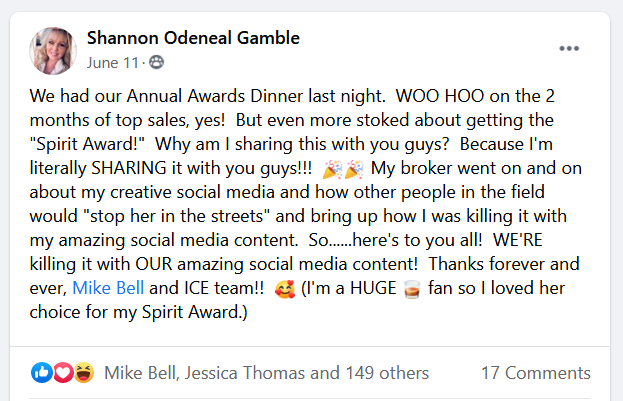

Social media is a blessing and a curse for real estate agents. It has made it so much easier (and less costly) to stay in

Fair Warning: This story isn’t exactly short. BUT… if you stick with me til the end, AND you’re a real estate agent, you’ll receive a

Depending on your situation, it may not take the full 30 minutes.

This reset password link has expired. Check the latest email sent to you.