Here’s Why You Should Re-Share Real Estate Content You’ve Shared Before… Again and Again

The Internet has really leveled the playing field for real estate agents. Years ago you needed a hefty marketing budget to be able to get

Every industry has jargon an outsider wouldn’t understand, and probably doesn’t need to know. But real estate is a field where almost every “outsider” needs a bit of insider knowledge in order to successfully buy, sell, or rent a place to live a few times in their lives.

For instance, you could go your entire life without hearing the term “comp” once, but the minute you decide to buy or sell a house you’ll hear agents say it like it’s a word you probably already know. It’s not nuclear physics, so you can probably figure out what they’re talking about, especially in the context they’re bringing it up. But just in case you’ve never heard the term before, “comp” is short for “comparable.”

Okay, but what exactly is a comparable?

Comparables are houses that are currently on the market, under contract, or (most importantly) recently sold. They’re used to compare against a house you’re planning to buy or sell, in order to establish approximately how much it should sell for in the current market. This helps you price it accurately as a seller, and know how much to offer as a buyer.

Comparables should be chosen in as objective a manner as possible, not to simply justify what you want to hear or think. Just because you want your house to be worth more than the data shows, doesn’t mean you can point to a house that sold for more and say it’s a true comp. Nor can you use a lower priced home as a comp to justify a low-ball offer, if it isn’t truly a good comparable for a house you’re trying to buy.

At times it can be pretty difficult for an agent or an appraiser to find many (or even enough) homes that are truly similar to the house you’re selling or buying, within a recent time frame. But ideally they are looking for houses that have:

In a perfect world, they’d be able to find three similar homes that are currently on the market, three that are currently under contract, and three that have closed within the past three months, and use all of them in combination to determine how much you should list a house for as a seller, or offer for a house as a buyer.

Almost everyone in the industry, government, and media seems to agree that the market is “shifting” right now. But it’s difficult to pinpoint what that means exactly, and opinions vary from one person to the next. Considering prices were skyrocketing and at all-time highs in the past few years, you’d think that meant prices are now coming down. What else could shifting mean?!

Well, it doesn’t necessarily mean that prices are going down in your area or price range. It also doesn’t seem to be translating into a buyers’ market everywhere either.

Data and news reports indicate that there are fewer houses selling, and it’s taking longer for them to sell in some areas than it has been in the past few years. But in many areas prices don’t seem to be plummeting, or even falling. In some areas prices are stable or even increasing.

The shift is affecting the market differently from one area to another, and one price range to another, so you can’t go by nationally based data and reports. You need to rely on good local comps to determine the value of a house you’re selling or buying.

But here are a few problems with comps in the current market that you need to be aware of:

So right now, sellers are often hanging onto “proof” that their house is worth a certain amount based upon sales prices that occurred when prices were at all-time highs. On the other hand, buyers often feel like prices should be coming down, based upon news of the market shifting, and the fact that interest rates going up have affected their buying power, but they don’t necessarily have “proof” to justify lower offers.

In the meantime, while the data catches up with the shift, your best bet is to rely on your agent’s experience and observations in the current market. What have they been seeing happen in your local area and price range? There may not be hard data to pull up yet, but a local agent is a good barometer for what buyers have been offering, how much sellers have been accepting, and how supply and demand has affected those two things in your area.

While comps are useful in determining values and how much to offer or accept for a house, when the market’s shifting you need to rely on your agent’s ability to gauge where the market is currently going before the proof actually appears in the form of comps.

The Takeaway:

“Comps” are short for the real estate term “comparables,” which are basically houses that are similar in size, location, and condition to a house you are selling or buying.

In a shifting market like we’re currently experiencing, it can be difficult to find enough comps, or get a true feel for where the market is going, because it takes time for houses to actually close. So the data can lag a bit.

Your best bet right now is to use comps as a basis, but also rely heavily on your agent’s experience and observations of what is actually happening in your area and price range currently.

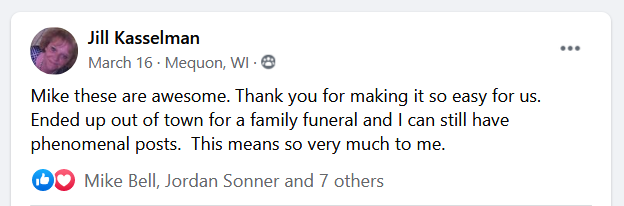

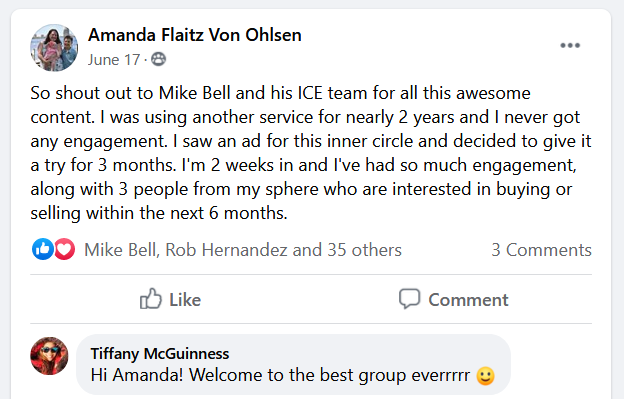

(Shh, our secret)

Show your sphere your an expert. We have over 2100 articles covering every real estate topic your audience will love.

Position yourself as a real estate authority!

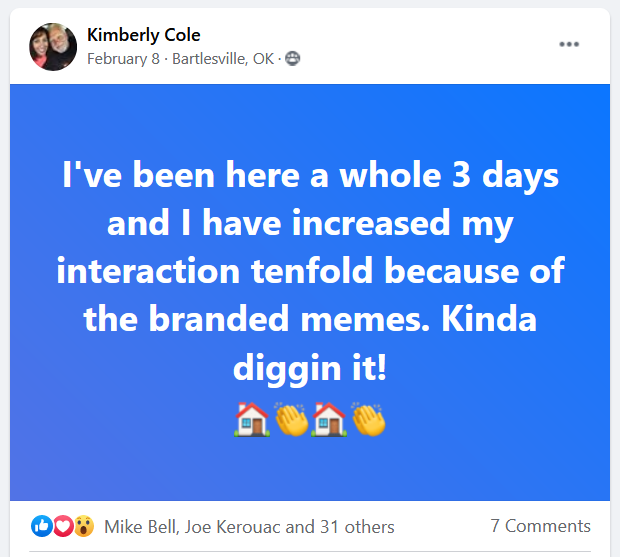

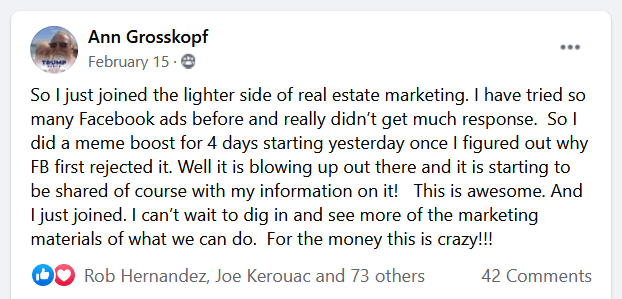

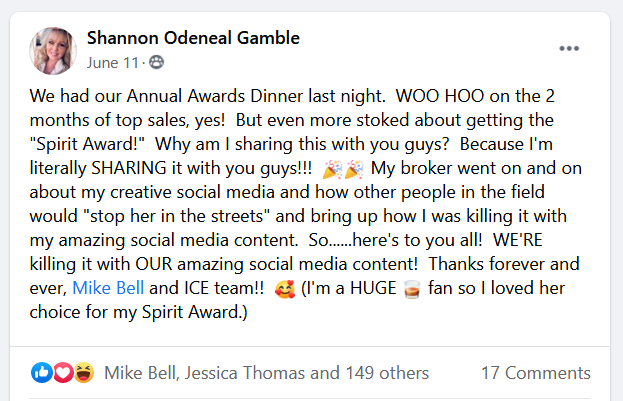

Real estate + topical events — the perfect match!

Become the bearer of good vibes!

Because hey, everyone loves to laugh!

Get our weekly email that makes communicating with your sphere on social actually enjoyable. Stay informed and entertained, for free.

The Internet has really leveled the playing field for real estate agents. Years ago you needed a hefty marketing budget to be able to get

We’ve all experienced the stress and tension of moving, right? Even after you’ve done all the footwork to find the perfect place, you’ve still got

Ideally, every client you work with would write you a heartfelt, glowing review…without being asked. But, alas, most don’t. It doesn’t mean they wouldn’t. But

If you’ve been wondering if you can start out as a real estate agent part-time until you can get enough business to go full time,

Open your inbox right now. Take a look. Go ahead. Chances are, it’s overwhelming. A wall of unread messages, combined with some that’ve been sitting

Depending on your situation, it may not take the full 30 minutes.

This reset password link has expired. Check the latest email sent to you.