The Secret Kardashian Formula Every Real Estate Agent Needs To Learn

When you’re starting or growing a real estate biz, it seems like everyone has advice. Some advice is good, like, “Share interesting content consistently!” Some

The new year is right around the corner, and many people are starting to think seriously about their New Year’s Resolutions. And while the most popular resolutions aren’t going anywhere (eat healthy, work out, spend less time in front of a screen), if you’re looking to buy a home next year, at least a few of your resolutions should be of the financial variety.

Starting the new year off on the right financial foot by making financial resolutions can set you up for success and help you get closer to your goal of buying a home. Here are four financial resolutions you should consider making if you want to buy a home in the new year:

It’s impossible to get a handle on your financial situation if you don’t know what this situation actually is. Which is why your first financial resolution needs to be to track your spending.

Tracking your spending will give you a clear picture of how much money you’re spending, where you’re spending it, and where the opportunities to cut back are.

The key to successfully tracking your spending is to track every single cent you spend. You can create a spreadsheet and manually input every purchase or you can use a money monitoring app like Mint; Mint connects to your debit and credit cards and then tracks and categorizes your purchases throughout the month.

Once you’ve tracked your spending for a month, it’s time to dive into the numbers. How much of your income are you spending on necessities (like living expenses and utilities)? How much is going towards paying down debt? How much are you saving?

It’s only when you have a clear idea of your financial situation that you can determine if you’re ready to buy a home — and, if so, just how much home you can afford without putting yourself in a financially challenging situation.

A great side effect of tracking your spending is that it allows you to see opportunities to cut back. Which leads into resolution #2: cut out any unnecessary expenses.

If you’re serious about buying a home, you need to rein in unnecessary spending and pad your savings account as much as possible. Are you spending a significant amount of money every month eating out at restaurants? Commit to eating out one or two times a month and making meals at home the rest of the time to save some cash. Is your coffee habit costing you $5 a day? Brew a cup in your kitchen before you leave for work. Are you spending a fortune on a gym membership you barely use? Cancel and use free workout videos on YouTube to get your exercise. Do you pay for premium cable when you’d be fine with basic? Downgrade and lower your bill.

Now, keep in mind — even though you’ll want to go into savings mode before you buy a home, that doesn’t mean you shouldn’t spend any money on yourself. If you don’t spend any money on fun and entertainment, it can actually make it harder to stick to your budget. Allot a certain amount of money per month you can use as you please; that “fun money” will make it easier to stick to your budget the rest of the time.

The more unnecessary expenses you cut out of your budget, the more you’ll have to put in your savings account — and the faster you’ll be able to make your dream of owning a home a reality.

Another financial resolution to make if you want to buy a home? Clean up your credit.

Your credit score plays a huge part in determining if you get a mortgage and, if so, how competitive your interest rates. A good credit score can save you thousands (even tens of thousands) of dollars over the course of your loan, which is why it’s important to get it as high as possible before you purchase a home.

First, you’ll want to get a copy of your credit report and check for any errors. Errors are more common than you’d think, and even a small mistake can drag down your score. If you find an error on your report, you’ll need to contact the credit bureaus to have it removed.

Once your report is error free, it’s time to do everything you can to boost your credit score. Paying down debt, paying all your bills on time, and keeping the percentage of credit used low can all help to increase your score — which will help you get a better deal on your mortgage when you apply.

There are plenty of resolutions you can make in order to hit your goals in the new year. But if your goal is to buy a house, these financial resolutions are the key to getting there.

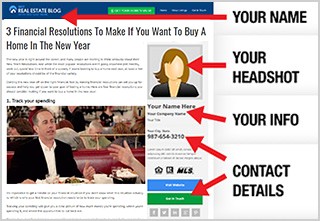

Members: Sign in here to share this article with your branding. Sign in here.

Not a member? Seriously? Learn how you can share articles like this one with your branding. Learn more.

Pin

Pin

(Shh, our secret)

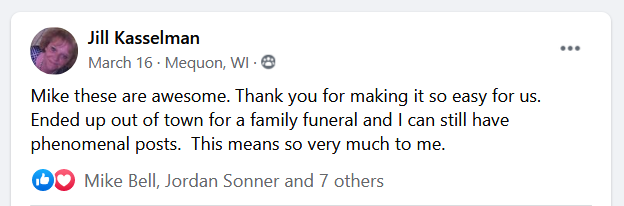

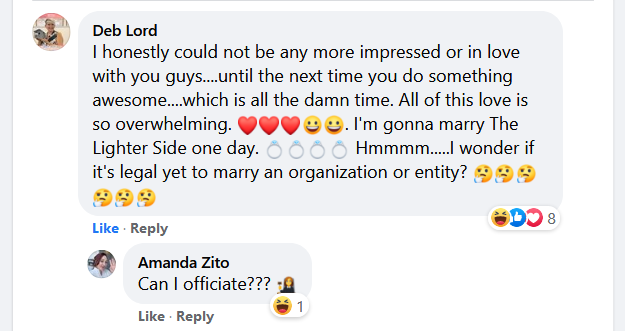

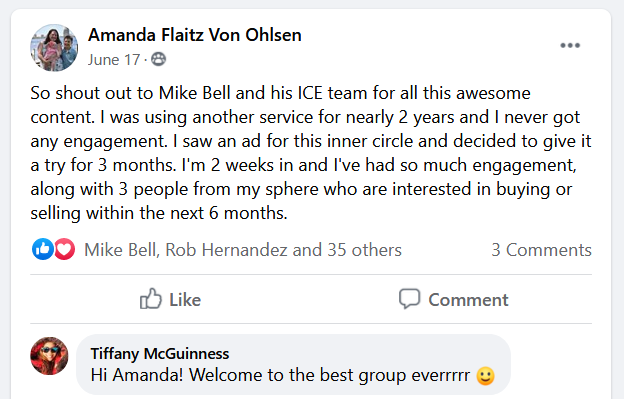

Show your sphere your an expert. We have over 2100 articles covering every real estate topic your audience will love.

Position yourself as a real estate authority!

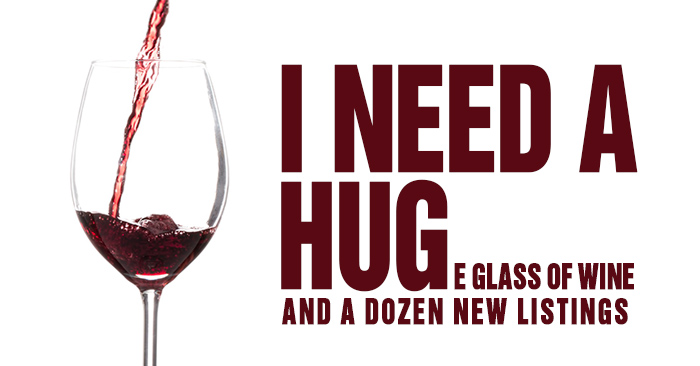

Real estate + topical events — the perfect match!

Become the bearer of good vibes!

Because hey, everyone loves to laugh!

Get our weekly email that makes communicating with your sphere on social actually enjoyable. Stay informed and entertained, for free.

When you’re starting or growing a real estate biz, it seems like everyone has advice. Some advice is good, like, “Share interesting content consistently!” Some

It’s tough to land listings in any market, but when you’re smack dab in the middle of a market with low inventory, they’re like lassoing

We’ve all experienced the stress and tension of moving, right? Even after you’ve done all the footwork to find the perfect place, you’ve still got

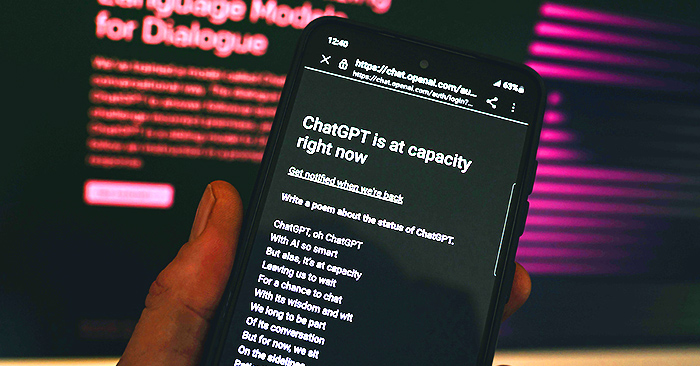

First and foremost, no, this article wasn’t written using artificial intelligence. Or does that sound exactly like something AI would say to throw you off

Open your inbox right now. Take a look. Go ahead. Chances are, it’s overwhelming. A wall of unread messages, combined with some that’ve been sitting

Depending on your situation, it may not take the full 30 minutes.

This reset password link has expired. Check the latest email sent to you.