5 Strategies for Real Estate Agents to Build a Better Sphere of Influence

You probably never even heard the term until you became a real estate agent. But once you became one, you were probably told how important

Pin

Pin

This list is not in any particular order. Number 1 isn’t more severe than Number 10.

Let’s make sure we’re being clear on one point. Most agents want their clients pre-approved before showing them properties. The difference is that clients get pre-approved before talking to an agent. But here’s something to think about. Only 32% of home buyers report a positive experience with their lender. Over 1/3 of home buyers reported a “very to extremely stressful” home purchase. Why?

Because their lender can’t close on their deal.

Agents are known for being able to close deals. And agents work with lenders who they know can close on a deal. If a lender can’t close the loan, you don’t get your house and nobody gets paid.

A few months back, I watched in horror as a lady-client was badgered nearly daily by a loan officer who could not get her home loan closed. We finally had to switch lenders and the new lender closed the loan in 2 weeks. Just for the record: a recent report indicated that only 32% of home buyers had a positive experience with their LENDER. Listen to your agent!

For some reason, when shopping for a home or even in escrow, people seem to want a new credit card. If you’re shopping at a clothing store and the cashier asks you if you want to save 10% by getting a store charge card say NO! A new credit card means they will run your credit which drops your credit score. And because you were approved, the lender now sees you have a new credit card with a new debt limit. Both the credit score drop and the credit limit impact your loan.

This is what I did as my mistake new home buyers make. I did this when I bought my first property. Two days later, the lender called me absolutely irate because my credit score dropped, thereby increasing my monthly payment and almost disqualifying me for the loan. All that to save $20.

Right in the middle of escrow, little Jimmy has a birthday and we MUST buy him the latest X-Box with the newest World of Warcraft. Oh he also needs that gorgeous iPad pro! BAM! Little Jimmy is happy and the world is a better place.

Not so fast. Charging up your credit card has a snowball effect on your home buying process.

There is a direct relationship between credit card balances and your credit. Look at what happens with you credit card balances.

Little Jimmy will live just fine without a new BMW for his birthday.

Unfortunately, this is a common mistake new home buyers make. It comes from old habits, whereby credit cards finance happiness. The best advice I can give is that you do NOT touch your credit cards at all during the escrow process. If anything, pay them down.

WHY?!? You’re buying a new house and you need a new car?!?! I get it. You’re buying a new house so why not have a new car to go with it. Right? Wrong! Unless you’re paying cash, you’re going to have to finance that car. And when you finance your car, it affects your finances. See bullet point 3.

Unfortunately this one stays with you for the duration of your lease or until you’ve paid off your car. Again, the charge on your credit is seen almost instantly by the lender, thereby raising your interest rate and raising your mortgage payment. Usually this demolishes a buyer’s plans on purchasing a home.

This ranks up in the top 5 mistakes new home buyers make. The excitement of purchasing a new home goes to their heads and they suddenly want a new car. After escrow closes, then you can buy the new car. I don’t recommend it but go ahead if you must after escrow.

Some friends of mine were expecting their first child. She went out on maternity leave 5 days before the end of escrow. Wouldn’t you know it: the lender called a day later to verify employment and freaked out to find out she wasn’t working anymore. The loan officer had to pull a miracle out of thin air to prevent them from losing the house. Wait until AFTER the close of escrow to change jobs.

This is what I call one of the “unknown” mistakes new home buyers make. Essentially when you’ve been pre-qualified, you should put your entire life on hold. No job changes, no new credit cards, no new charges on your credit cards. Nada. Don’t do anything.

I often equate house hunting to dating. It’s easy to fall in love with someone until you meet their nightmare family. Same with a house. You fall in love with this property and you absolutely MUST have it! Forget the neighborhood!

PinPinWhen you buy a home, you’re also buying the neighborhood.

A few things. First: your agent should be able to give you data on the neighborhood so you know how the neighborhood is doing economically. Second: your agent should be able to tell you about any surprises going on in that neighborhood. Third: always visit the neighborhood late on a Saturday night. What do you hear? Oh look! There’s a Death Metal Mariachi Club that comes alive at night that caters exclusively to meth dealers and biker gangs. Discounting the neighborhood is another of the common mistakes new home buyers make.

You’re in love with a home that’s two hours away (factoring in traffic) from your job? Sweet Moses smell the roses! That’s four hours a day, five days a week. That’s 20 hours of your life every week that you’re not getting back. Maybe its best to consider the time you’ll spend in the car, away from your family and life in general. People do make that trek every single day. All the power to them!

If you grind this drive every day, it will wear on you. Most people, confident they can handle it, start envisioning a commute that is 15 minutes and not 2 hours. Unfortunately you’re stuck in your house for a few years before it becomes monetarily sane to sell and find some place closer to your work. Underestimating the commute is another common mistakes new home buyers make.

Appreciation is how much a home’s value will increase (or decrease) over time. Markets go up, markets go down. It’s a fact of life. While everyone certainly remembers the housing crash that started in 2008, they forget that the mid 1990’s was also another crash. There was also one in the 1980’s. The 1970’s and 1960’s had one as well. Actually every decade has experienced a housing crash. It is not a question of “if” but “when”. My axiom is that there’s never a bad time to buy but there are horrible times to sell. Your long term focus should be on paying down your mortgage and becoming debt free.

I hear clients say “Yeah, I’ll buy this house and in 2 years my house value will have doubled!” Um… no one guarantees that and you shouldn’t think that way.

Home inspections usually cost $300 to $400. But Uncle Bob is a contractor! He can do it for free! Have a professional home inspector do your inspection for you. Every qualified home inspector has a detailed list of EVERYTHING that needs to be inspected in a house. Your Uncle Bob won’t and usually doesn’t. When negotiating with the seller, the only source a home buyer will have to use is the home inspection report. If it is not listed in that report, you won’t be able to negotiate with the seller on any needed repairs.

PinPinIt’s the buyer’s responsibility to make sure the inspector they use is qualified, certified and thorough with their home inspection.

Again, your agent has a ready-made list of inspectors who are top-notch.

This is not one of the common mistakes new home buyers make. It only seems to impact those people who feel they must always “have the deal”. They start looking at ways to cut corners. When you’re making your biggest financial investment decision, now is not the time to cut corners.

House hunting is like dating. You’ve discovered your big “Why I want to purchase a home.” You’ve made a list of all the items that you need to support your vision. Suddenly you see a house that you absolutely MUST have. You’re dancing barefoot in the tulips! The problem is the house doesn’t have anything you indicated that you need. But you MUST have it! You lose your head, overpay for the house and forgive all those problems with it.

A year later, you’re miserable. All those problems your inspector found now haunt you and your wallet. This is the problem when you buy a home based purely on emotion.

The flip side to this is that you fall in love with a house, put down an offer, and you don’t get the house. Someone put in a better offer and that was accepted. It happens.

This is the most powerful of the mistakes new home buyers make. Emotions can get the best of us. That’s why it’s important to make sure you remain focused on your “Why” and keep looking for a house.

There’s probably a myriad of other mistakes new home buyers make but these are the ones I’ve witnessed more times than I can count. At the end of the day, the biggest mistake is that new home buyers ASSUME that once they are pre-approved that everything is set. They don’t realize that the lender is watching their finances very closely. Any change and they are all over you!

(Shh, our secret)

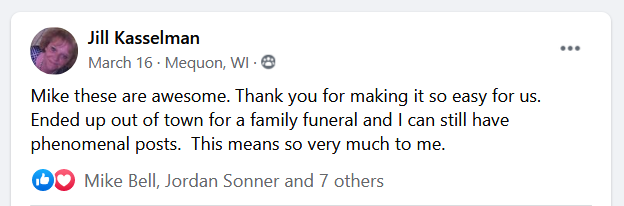

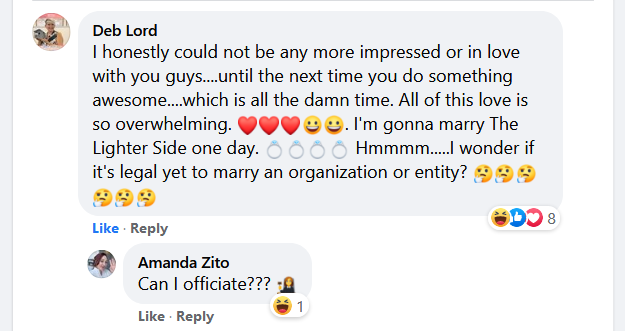

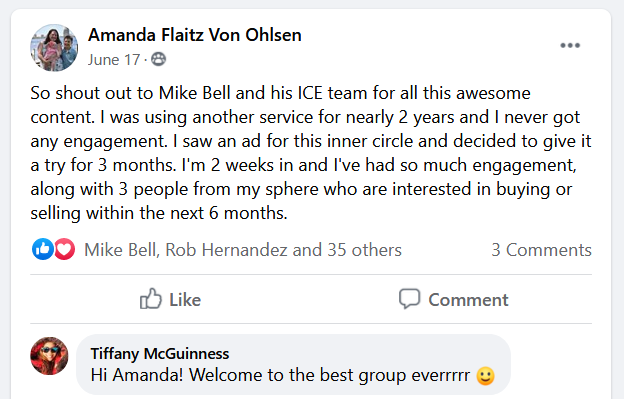

Show your sphere your an expert. We have over 2100 articles covering every real estate topic your audience will love.

Position yourself as a real estate authority!

Real estate + topical events — the perfect match!

Become the bearer of good vibes!

Because hey, everyone loves to laugh!

Get our weekly email that makes communicating with your sphere on social actually enjoyable. Stay informed and entertained, for free.

You probably never even heard the term until you became a real estate agent. But once you became one, you were probably told how important

Ideally, every client you work with would write you a heartfelt, glowing review…without being asked. But, alas, most don’t. It doesn’t mean they wouldn’t. But

Question: Have you seen the postcards most agents send out? BOOOR-ING! I’m pretty sure they make the prospects sleep-walk on their way back inside the

Real estate agents are very familiar with making offers on behalf of clients, since they’re often writing them for buyers. But very few agents are

Open your inbox right now. Take a look. Go ahead. Chances are, it’s overwhelming. A wall of unread messages, combined with some that’ve been sitting

Depending on your situation, it may not take the full 30 minutes.

This reset password link has expired. Check the latest email sent to you.