4 Creative Ways to Land Your First Real Estate Listing

Listing your first house can take some time when you get into real estate. And we’re not talkin’ just weeks or months—it can take years!

Whether you rent or own a place to live, having a roommate can certainly help make it easier to afford. Typically, if you have a roommate, you probably just split the costs 50/50. If there’s a third roommate, everyone pays a third. A fourth cuts it down to each person contributing 25% to the communal costs. Regardless of whether you’re best friends, or mere acquaintances, there’s somewhat of a business relationship to it.

But what about when your roommate is your significant other?

If you’re going to live with someone else to share the cost of living, why not live with the person you love? Years ago it was less socially acceptable for people to live with their “better half” before tying the knot. But times have changed, and more and more people are choosing to live together before getting married… if they even ever get married.

So, if you’re committed to each other, and feel confident you’re in it for the long haul together, renting or owning a home together makes as much sense (if not more) than sharing a place and expenses with any other roommates you could choose.

But, splitting the bill might be a little more complicated of an issue and topic than it would be with someone who is just a roommate.

According to a recent study by Thriving Center of Psychology, 3 out of 5 unmarried couples live together before getting married. In particular, 65% of Millennials cohabitate, and 35% of the younger Gen Z generation are also doing so.

While 85% of them said they moved in together because they wanted to, 61% of Millennials and 39% of Gen Z said that finances also played a part in their decision. But half of them aren’t splitting the costs equally, which makes 37% of those surveyed feel like the relationship is financially unequal.

The good news is that most couples are happy with their decision to live together. However, 29% wish they communicated their expectations more clearly before moving in together.

It’s great that most report being happy, but money and finances are often the source of issues for couples — married or not — which can lead to breakups.

Buying or renting a home together is a contract much like marriage, and both people need to do their part to make it work. Well, technically nobody needs to do anything… but when one person feels like they’re doing more than the other person, that’s where things get dicey.

So let’s take a look at some steps you can take to avoid letting money become an issue in your relationship and home together.

Just because you haven’t strolled down the aisle and exchanged vows and rings, doesn’t mean you’re off the hook for being there for each other no matter what life throws at you. And sometimes in life, one person earns more than the other person. How much one of you earns isn’t the only thing they bring to the home and relationship.

It would actually be pretty odd if you both earned the same amount of money. So the chances are one of you will earn more than the other. It doesn’t matter which side of that equation you’re on, it’ll come with some potential emotions and perceptions. If you earn more, respect that your mate might really feel bad about that, or wish they could contribute more. If you earn less, respect that your partner could feel like they carry a lot of the financial weight on their shoulders. Being aware and considerate of how the other person feels can go a long way.

It might sound basic, but communication can help overcome many issues couples have. Unfortunately, it’s not something everyone is good at. But if you can agree to communicate openly and honestly ahead of time, it will likely help you avoid little grievances building up inside and coming out once the damage is done.

Even if one person earns more than the other, maybe you can decide to base how much money you spend on rent or a mortgage so that each of you can chip in 50/50. But if not, or you just decide you want a better place than that would afford you, discussing it and making that financial decision together is at least out in the open. To avoid one person feeling like they’re bearing more weight than the other, perhaps the one who can’t contribute as much financially takes on more of the responsibilities around the home, or some other form of give and take.

Setting finances and each person’s responsibilities in stone might not seem romantic or feel right for every couple, but it can be a useful way to keep you both on the same page and not let things get too out of control. It’s easy to claim months or years down the road that one of you never said or promised something, when it was just a conversation which occurred in the past. But if you document it, and even revisit the agreement on a yearly basis, it can serve as a way to address how each of you are feeling, and help you maintain a happy relationship and home.

Ideally this is something you’re reading before moving in together and can take these steps ahead of time. But if you’re already living together and haven’t had these conversations, there’s no time like the present.

The Takeaway:

Many Millennial and Gen Z couples choose to live together before getting married. While most report being happy with the decision, a survey recently revealed that 37% of them feel like the relationship is financially unequal, and 29% wish they communicated their expectations more clearly before moving in together.

Before moving in together, or before things reach a boiling point if you already live together, make sure you have open discussions about finances and how much, and what, each of you will be responsible for in the home.

(Shh, our secret)

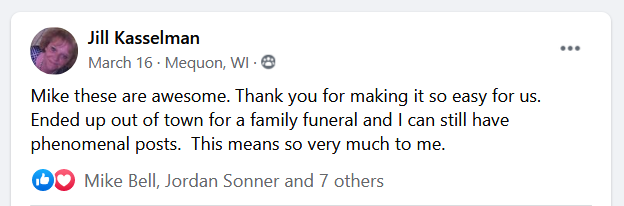

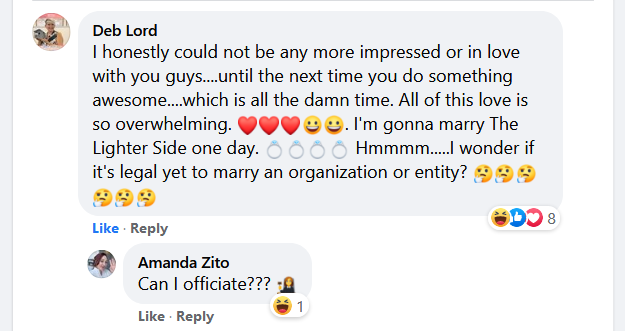

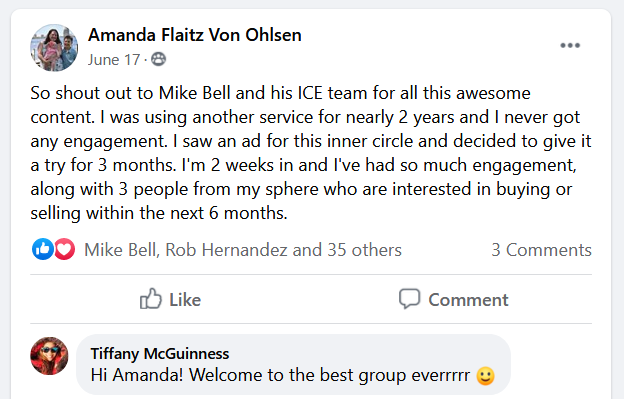

Show your sphere your an expert. We have over 2100 articles covering every real estate topic your audience will love.

Position yourself as a real estate authority!

Real estate + topical events — the perfect match!

Become the bearer of good vibes!

Because hey, everyone loves to laugh!

Get our weekly email that makes communicating with your sphere on social actually enjoyable. Stay informed and entertained, for free.

Listing your first house can take some time when you get into real estate. And we’re not talkin’ just weeks or months—it can take years!

Most real estate agents use social media as a means of marketing themselves, at least to some degree. Some agents are able to build a

Real estate agents come in all shapes, sizes and personality types, and not all of them fashion themselves as true salespeople. “I’m a consultant,” they

In the world of real estate, first impressions don’t happen at the front door—they happen on a screen. Before buyers ever set foot on the

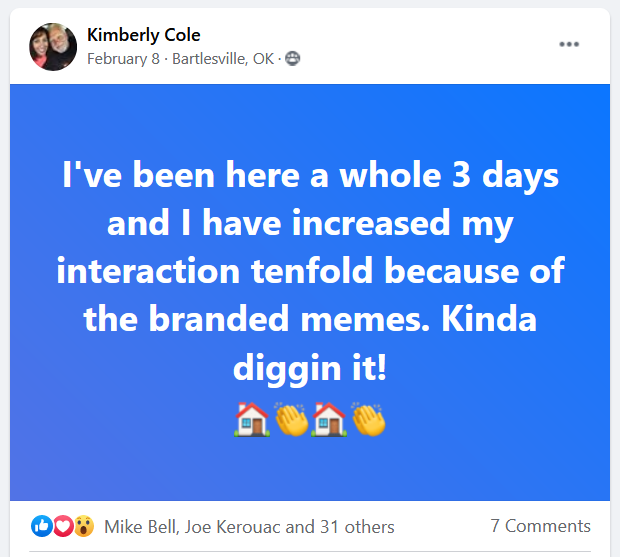

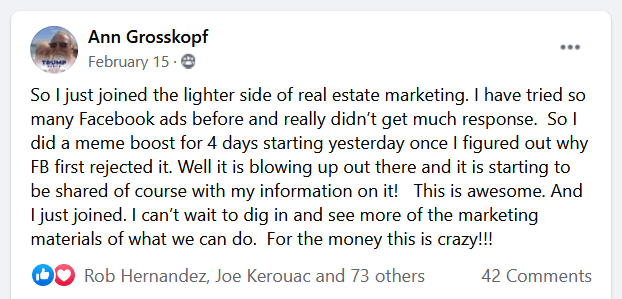

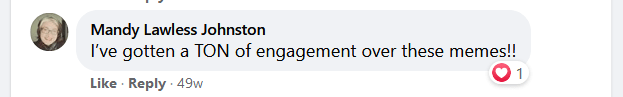

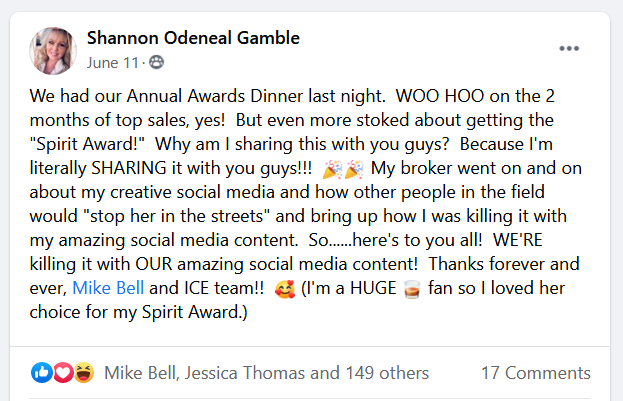

In this spirit of transparency, we admit we’re totally biased when we say “the most clever.” Why’s that? Because we created them. At any rate,

Depending on your situation, it may not take the full 30 minutes.

This reset password link has expired. Check the latest email sent to you.