Should You Join a Real Estate Team? Sure, as Long as You Do This!

At some point in their career, almost every agent either considers joining a team, or is asked to join one. It’s not the right move

Buying your first house has never been easy, but for today’s younger generations, it’s increasingly out of reach. High interest rates, soaring home prices, and the heavy burden of student loan debt have made it difficult for young folks to purchase a home on their own.

Even cutting out lattes or avocado toast doesn’t do much to bridge the gap. And forget about hanging out with friends and taking memorable trips together if you’re trying to buy a house. Saving up to buy a home can feel like you’re forgoing the fun of life itself, while not making much progress toward homeownership anyway.

But what if there were a way to combine the two? What if you could own property and spend quality time with your friends enjoying some food and drink in the comfort of your own home?

Well, if that sounds great to you, perhaps you should consider pooling your resources and buying a “friend compound” together.

According to a recent article in The San Francisco Standard, buying friend compounds has become increasingly appealing, and data shows that 14% of millennials have purchased property with friends, and a whopping 70% of Gen Z say they’re open to the idea.

Here are a few things that make co-buying appealing:

While this all might sound exciting and prompt you to start planning to buy your own friend compound with a bunch of friends over beers in front of a fire pit, it’s important to stay grounded and be practical if you really want to make it happen.

So let’s look at some pros, cons, and tips you should consider before putting your plan in motion…

Co-buying with friends can be a path to financial stability and a richer social life. Here’s why it works for many:

While the concept is appealing, it’s not without its challenges. Co-buying comes with its own set of risks and complications.

To turn the dream of communal living into reality, it’s crucial to approach the process with a mix of practicality and foresight.

The Takeaway:

“Friend compounds” are a creative way for anyone struggling to afford homeownership on their own to buy a home by pooling resources. But not only does it curb costs, it also provides the opportunity to handpick your neighbors, and create a lifestyle filled with supportive friends right next door.

But success requires thoughtful planning, open communication, and the right professional support. However, with the right mix of friends, foresight, and guidance, you can turn the dream of owning a home into a reality. Whether it’s shared morning coffees or a backyard barbecue, the memories you create could make the effort more than worth it.

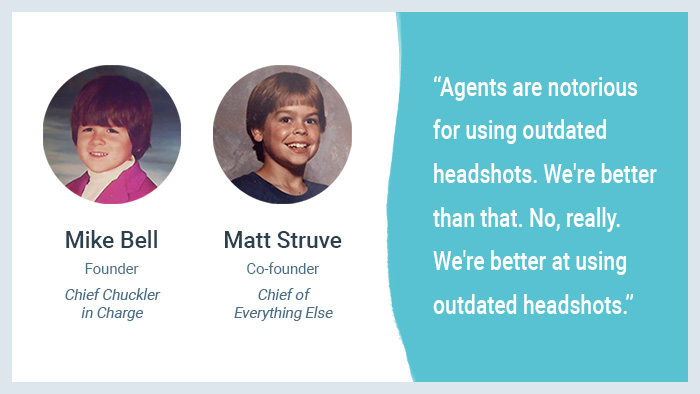

(Shh, our secret)

Show your sphere your an expert. We have over 2100 articles covering every real estate topic your audience will love.

Position yourself as a real estate authority!

Real estate + topical events — the perfect match!

Become the bearer of good vibes!

Because hey, everyone loves to laugh!

Get our weekly email that makes communicating with your sphere on social actually enjoyable. Stay informed and entertained, for free.

At some point in their career, almost every agent either considers joining a team, or is asked to join one. It’s not the right move

Every agent needs a lead list. They are compilations of prospects you can reach out to when you are trying to drum up business. They

It hits you like a ton of bricks the first time you hear it could take months (or even years) for a real estate lead

Fair Warning: This story isn’t exactly short. BUT… if you stick with me til the end, AND you’re a real estate agent, you’ll receive a

You probably never even heard the term until you became a real estate agent. But once you became one, you were probably told how important

Depending on your situation, it may not take the full 30 minutes.

This reset password link has expired. Check the latest email sent to you.