7 Clever Postcard Ideas For Halloween

Question: Have you seen the postcards most agents send out? BOOOR-ING! I’m pretty sure they make the prospects sleep-walk on their way back inside the

If you own a home, there’s a good chance you’re sitting on a nice chunk of equity. According to this report from Black Knight, the average homeowner got a $48,000 bump in their home value, raising the average equity to $185,000 in 2021.

Considering mortgage rates are still historically low, and home values are high, it can be tempting to tap into your home like it’s an ATM. With hints of rates going up, and values potentially coming down, it can be even more tempting to rush and pull equity out of your house.

Before you do, consider whether or not you should. Take a look at some reasons to tap into your equity, and some reasons not to pull money out of your house:

If you determine it makes sense to turn your equity into cash, you have a few options:

This type of loan allows you to refinance your home for a higher amount than you currently owe, and take the difference in cash. For instance, you owe $100,000, take out a $150,000 loan, and get $50,000 cash. This can be a great option if your current mortgage is at a rate that is higher than current rates, or you have paid down your original loan substantially over time.

These are a second mortgage on your home, usually at a higher rate than the first. Lenders may also be a bit more careful about how much they will lend, since these take second position to your original mortgage if the home is foreclosed on.

These are commonly referred to as a “HELOC.” They’re also a second mortgage, but in the form of a revolving line of credit, much like a credit card. The rate is often variable and fluctuates with changes in the market, but you can find some that are fixed-rate.

The Takeaway:

The current market conditions are favorable for tapping into your home equity if you have a good amount of it. If you decide to do so, just make sure it’s for a good reason. Try not to take out too much equity. Maintaining 20% equity is an ideal benchmark — taking into consideration that values could also drop a bit in the near future — so be safe when estimating how much you’re taking out.

No matter what your reason, only do so if you know you can handle the payments and it won’t put your hard-earned equity and home at risk. And, as always, make sure to seek the advice of your financial advisor, estate planner, and / or real estate agent before turning the equity in your home into cash.

(Shh, our secret)

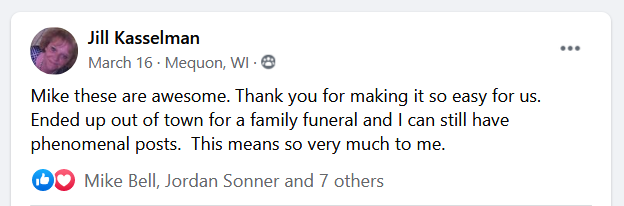

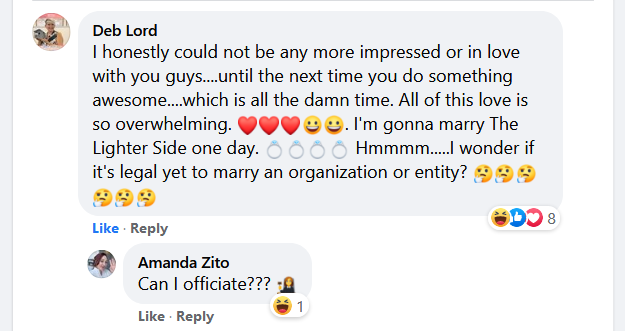

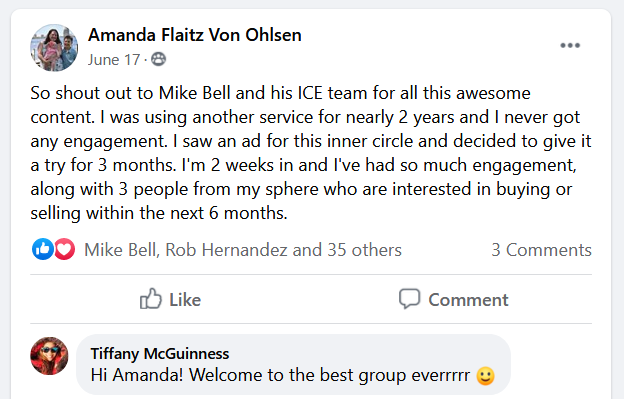

Show your sphere your an expert. We have over 2100 articles covering every real estate topic your audience will love.

Position yourself as a real estate authority!

Real estate + topical events — the perfect match!

Become the bearer of good vibes!

Because hey, everyone loves to laugh!

Get our weekly email that makes communicating with your sphere on social actually enjoyable. Stay informed and entertained, for free.

Question: Have you seen the postcards most agents send out? BOOOR-ING! I’m pretty sure they make the prospects sleep-walk on their way back inside the

At this point everyone knows not to fall for the email from a Nigerian prince promising to share his fortune with you if you just

It hits you like a ton of bricks the first time you hear it could take months (or even years) for a real estate lead

Depending on who you ask, content marketing is either the oldest trick in the book… or the next big thing. It’s been called everything from

There’s no way around it… Now, more than ever, you’ve GOT to stand out as a real estate agent. To say our industry is over-saturated

Depending on your situation, it may not take the full 30 minutes.

This reset password link has expired. Check the latest email sent to you.