2 Selfish Reasons Sellers Should Still Offer to Pay a Commission to Buyers Agents

If you’ve been planning on selling your house, or are currently in the middle of doing so, you’ve probably heard that there will be some

Pin

Pin

Let’s face it, loan officers have gotten a pretty bad rep ever since the mortgage crisis and subsequent recession almost brought down the global economy. Much of it is well-deserved, as the mortgage industry attracted some unscrupulous fly-by-nighters that came in to make a small fortune and get out just as quickly. But most of those people are now long gone, and thanks to them there are a bunch of rules and regulations that don’t always make much sense.

I was an LO for years, so I know the ups and downs, and I also know how tough it is for agents who don’t always see the lending side of things as making sense, because very often it doesn’t! So without further adieu, here are 5 things your loan officer wants to say to your face, but can’t (or won’t):

Nearly every loan officer I have ever worked with, including myself, has at one time or another considered the prospect of becoming a real estate agent themselves. Some actually pull the trigger, but most stay where they are or move onto another form of sales. The reason why it seems so appealing is that most LO’s are sitting behind a desk all day pushing papers around and getting yelled at by sales managers (ok, maybe it’s a little more than that). But we think of real estate agents as out on the open road, looking at cool houses and meeting with clients for coffee and lunch, and sometimes we feel that little ping of jealousy and think to ourselves, “Man. That could be me.”

Every loan officer worth his or her weight in discount points will always tell a client not to take out any new debt during the lending process as it could put the whole mortgage loan in jeopardy. The last company I worked for actually sent out a document along with the opening package literally spelling this out in big, bold lettering. Unfortunately, customers sometimes either don’t listen, or don’t understand this simple concept. So if your client rolls up to the inspection in a brand new Audi, it’s probably not the loan officer’s fault.

Unless an LO is lucky (or unlucky depending on how you look at it) enough to be working for an inbound call center, or a company that provides high quality mortgage leads, their relationships with real estate agents are critical to their success. An LO who has developed strong partnerships with local agents can count on some level of steady business, and not have an anxiety attack every time they come into the office and see that they’ll be calling LowerMyBills.com leads all afternoon. While most loan officers are too afraid to admit it, real estate agents are incredibly important to them.

Arguably, the only thing a loan officer actually has control over is their own understanding of mortgage programs, their work ethic, and some wiggle room when it comes to mortgage rates and pricing, although that’s usually dictated by their bank/employer. Everything else is set by Fannie and Freddie guidelines, bank overlays, and government regulations. A loan officer is only in control so far as they properly interpret guidelines before promising a customer that they can get things done, and since there is sooooo much that can go wrong during a mortgage transaction these days, many LO’s simply can’t anticipate what absurd kinds of things underwriting will take issue with (think divorce decrees or condo docs).

This one comes with a caveat; there ARE still scumbags who are in the mortgage industry, as there are with many other industries. But, the new NMLS licensing requirements, strict background checks, more complicated rules for lending, and the fact that the mortgage business is not a “make a quick-buck” industry anymore has really weeded out many of the bad apples. Most loan officers are simply regular folks trying to make a living and support their families. They are also people who deal with a very stressful job that still comes with a lot stigma attached to it — stigma that probably isn’t going away anytime soon. So the next time you hear from your loan officer, let them know that you understand some of what they’re going through!

Ken K. is a former Loan Officer and founder of the sales website thesalesside.com as well as the popular Sales Humor Facebook page. He lives in New England and has a deep appreciation for what people in the real estate industry go through. He can be reached at [email protected]. Read Ken’s other articles here.

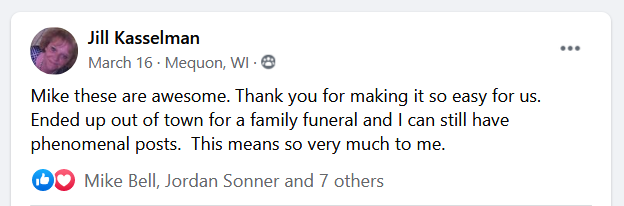

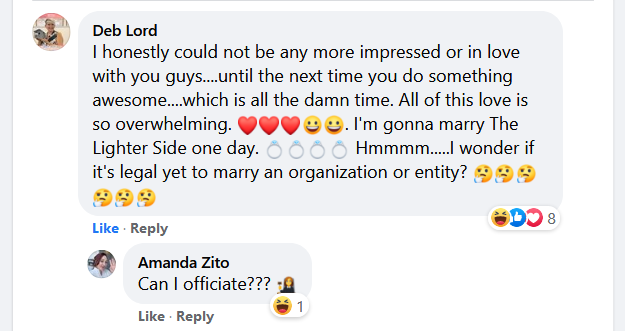

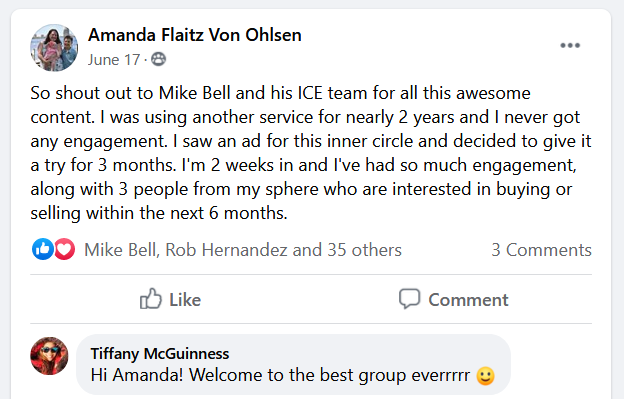

Get our weekly email that makes communicating with your sphere on social actually enjoyable. Stay informed and entertained, for free.

Show your sphere your an expert. We have over 2100 articles covering every real estate topic your audience will love.

Position yourself as a real estate authority!

Real estate + topical events — the perfect match!

Become the bearer of good vibes!

Because hey, everyone loves to laugh!

If you’ve been planning on selling your house, or are currently in the middle of doing so, you’ve probably heard that there will be some

Every day can seem like April Fools’ Day in real estate, considering all the crazy stuff that happens on a daily basis in this business!

If you think being a Realtor is easy and we just tour pretty houses…. Well here is the perfect example of how wrong you are.

Deciding to sell your house is a significant, often emotional, decision. Whether it’s for a bigger place, a better school district, a shorter commute, downsizing,

(2:50 video) Via youtube.com While you’re here, check out these two other videos. Brace yourself for cuteness overload. 🙂 (0:22 video) (0:13 video)

Depending on your situation, it may not take the full 30 minutes.

This reset password link has expired. Check the latest email sent to you.