Agents: How To Not Suck At Social Branding (even if you have the personality of a lockbox)

There’s no way around it… Now, more than ever, you’ve GOT to stand out as a real estate agent. To say our industry is over-saturated

In today’s shifting market, more homeowners are finding themselves in a tricky spot. They want to sell, but the offers aren’t coming in—at least not at the price they need or expected.

High interest rates have cooled buyer demand in many areas. Inventory levels are shifting. And sometimes, it just comes down to bad timing. Whatever the reason, more listings are sitting, and that can create real problems for sellers who need to move or are counting on the proceeds from a sale.

When selling doesn’t make sense, renting can feel like a solid backup plan. You keep the property, find a tenant, and let the rent help cover the mortgage. In some cases, you might even pocket a bit of income each month. That approach is becoming increasingly common, especially among homeowners who never set out to become landlords.

If you’re in this situation, you’re not alone. More and more homeowners across the country are finding themselves in the same boat, and as Yahoo Finance recently reported, there’s even a name for it: accidental landlords.

These aren’t seasoned investors or aspiring property moguls. They’re everyday homeowners who had to move for a job, couples who outgrew their first home, empty nesters with too much space, or people who inherited a house they don’t plan to live in.

And while renting the place out may seem like an easy solution, many quickly learn that becoming a landlord isn’t always as simple—or as profitable—as it might appear.

If you’re thinking about going this route, it’s worth taking a beat and considering a few important factors before diving in.

Renting out your home might seem like the obvious solution, especially when the market isn’t working in your favor. But it’s not as simple as collecting a check on the first of each month and calling it a day.

Here are a few things to keep in mind before you hang that “For Rent” sign:

Current IRS rules allow you to exclude up to $250,000 in profit from the sale of your primary residence (or $500,000 for married couples filing jointly), but only if you’ve lived in the home for at least two of the past five years. Renting out your property for too long can disqualify you from that exemption.

So if you’re planning to rent it out now and sell later, it’s worth mapping out a timeline—and talking to a tax professional—so you’re not hit with a larger tax bill than expected when it’s time to sell.

If you’re not familiar with local regulations, get familiar. Or work with someone who is.

While you may not have planned on becoming a landlord—it doesn’t mean it has to turn into an accident waiting to happen.

If you’re going to rent out your home, go into it with your eyes wide open. Think beyond the short-term fix or the monthly rent check and take the time to look at the full picture. What could go right? What could go wrong? Are you prepared for worst-case scenarios—and set up to make the most of the best ones?

Treat it like a business venture, not a last-minute backup plan. That means having a solid plan in place for maintenance, repairs, tenant screening, lease terms, and financial gaps. The more seriously you take it from the start, the better chance you’ll have of avoiding stress later.

And before you commit to renting, have a conversation with a local real estate agent. They can help you weigh your options clearly—whether renting truly makes sense right now or if selling could actually be the better move, even if it doesn’t seem that way at first.

The Takeaway:

It’s not always possible to sell at the price or pace you want in today’s market. That’s why more homeowners are becoming “accidental landlords,” choosing to rent out their home rather than sell it.

But renting isn’t a set-it-and-forget-it solution. Between managing tenants, handling repairs, and navigating taxes and timelines, it’s more work—and more risk—than many expect.

If you’re thinking about renting your home, don’t rely on gut instinct or friendly advice alone. Think like an investor. Consider the pros, the cons, and the what-ifs. And most importantly, talk to a real estate professional who can help you make the most informed—and intentional—decision possible.

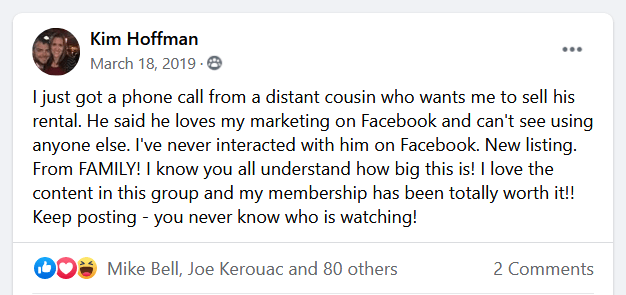

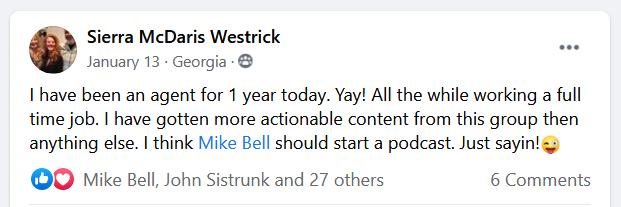

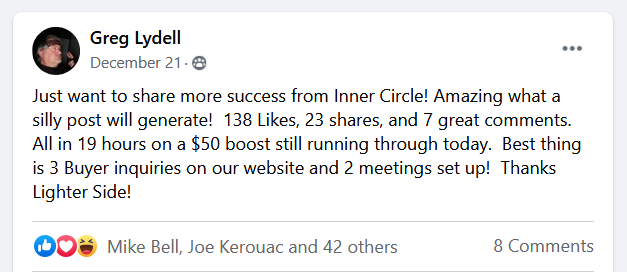

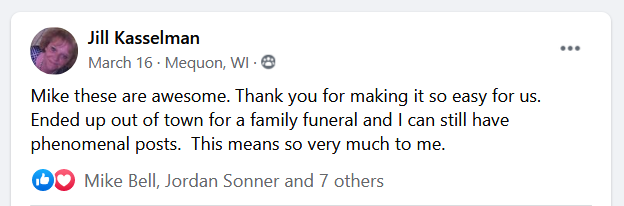

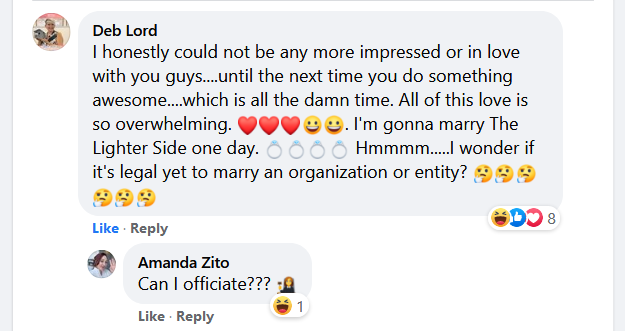

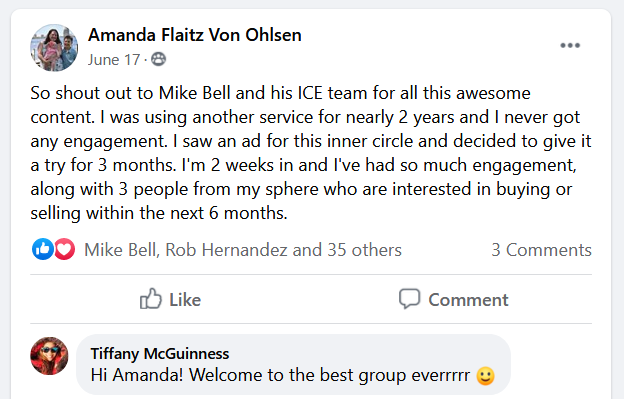

(Shh, our secret)

Show your sphere your an expert. We have over 2100 articles covering every real estate topic your audience will love.

Position yourself as a real estate authority!

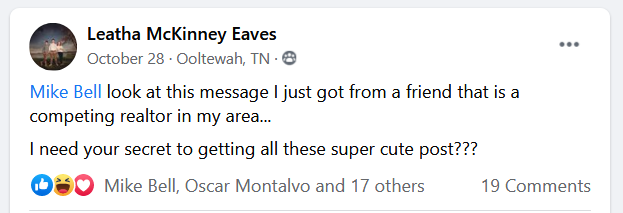

Real estate + topical events — the perfect match!

Become the bearer of good vibes!

Because hey, everyone loves to laugh!

Get our weekly email that makes communicating with your sphere on social actually enjoyable. Stay informed and entertained, for free.

There’s no way around it… Now, more than ever, you’ve GOT to stand out as a real estate agent. To say our industry is over-saturated

In high school, your math teacher may have said something along the lines of, “You won’t have a calculator with you all the time.” Fast

It hits you like a ton of bricks the first time you hear it could take months (or even years) for a real estate lead

Customer Relationship Management (CRM) systems are a necessary evil for real estate agents. Ideally they’ll make your life easier, keep you organized, and help you

Whether you’re a real estate agent looking for that perfect closing gift for your client, or just someone wanting to create something unique, you’ll want

Depending on your situation, it may not take the full 30 minutes.

This reset password link has expired. Check the latest email sent to you.