11 Specific Real Estate Niches with Prospects Just Waiting for You To Guide Them

“Let me know if you or anyone you know is thinking about buying or selling a house in the near future!” Sound familiar? Even if

If you’re thinking about buying a house, you might feel that mortgage rates are high and that it might make sense to wait until rates come down before buying.

According to this CNBC article, you’re not alone if you feel that way. A recent survey done by John Burns Research and Consulting found that 71% of prospective buyers aren’t willing to take on a 30-year mortgage unless it’s 5.5% or lower. This explains why there aren’t as many active buyers in the market as there were in the past few years, since rates are currently in the mid 6% range.

Interestingly, the consulting firm reported that their survey also revealed only 55% of prospective buyers feel like it’s not a good time to buy a home, and 22% feel it is a good time to buy. Simply put, there are a lot of prospective buyers who won’t buy a house right now, even though they actually feel like it’s a good time to do so.

To be fair, the potential buyers who feel that way have gotten used to mortgage rates that were considerably lower than they currently are for quite a few years. But they’re choosing 5.5% on emotion, rather than data. According to data from Freddie Mac, the average rate over the past 50 years was in the 7.75% range.

The first time 30-year mortgage rates had a number 5 as a first digit on a regular basis was in 2003. But even from then through late 2008, rates were as likely to be in the mid to high 6% range as they were in the mid 5% range. Mortgage rates only came down below 5.5% on a regular basis due to two major events: the 2008 financial crisis and the COVID-19 pandemic.

That was a fairly long span of years where people got used to the rates being lower, so it’s understandable why many potential homebuyers feel like a 5.5% rate is “historically normal” — even though it actually isn’t — but it was being done in order to stabilize the economy during extremely trying times. If you think about it, the good news is that we’re no longer dealing with such difficult times, and things are going back to normal. Well, at least in some ways…

The real estate market is still trying to figure out what “back to normal” is.

By nature, the real estate market is rarely perfect for everyone. Sometimes it’s more balanced than others, but it’s usually more in favor of buyers versus sellers, or vice versa. Over the past few years it was most certainly a sellers’ market. Many people who listed their house in the past few years received multiple offers, and were able to sell their homes for over asking price in a matter of days. Great for them, but very difficult for buyers.

Buyers had to brace themselves for bad news every time they submitted an offer on a house. Even if they offered way above asking price and waived all contingencies, there was a good chance they wouldn’t be the winning bid. Plenty of buyers lost out on dozens of houses before they finally landed a house, and many others just gave up trying.

Back then, buyers couldn’t wait for the competition to die down…

Well, it has!

While higher interest rates aren’t something any buyer wants, they’re also exactly what many buyers need in order to have a fair shot at finding and buying a house they want. Lower rates don’t do you any good if you can’t actually buy a house. And if rates do come back down to where the majority of buyers polled say they want them to be, the competition will probably kick right back up. (Especially when you consider how many of the prospective buyers recently polled felt that now is a good time to buy, but want rates to hit 5.5% in order to do so.)

So, at least for right now, there’s a window of time where you have less competition to buy a house, and may not have to offer over asking or waive contingencies meant to protect you, like so many people had to do in the past few years.

And, who’s to say rates won’t only not go back down to 5.5%, but rather go up instead? Considering the rates have truly been closer to 7.75% historically — and for much longer periods of time — there’s as much chance of that happening as there is for rates to decrease. But if you buy now and rates do end up going back down, you can always refinance if they go down enough to make it worthwhile.

The Takeaway:

Many potential homebuyers feel like mortgage rates are too high and are waiting for them to come back down to what they feel is the “historically normal rate” of 5.5% before they buy a house. However, the historical average for mortgage rates is actually 7.75% over the last 50 years. So the current rates in the mid 6% range are still below the historical average.

Interestingly, even though 71% of buyers polled said they’d wait for rates to come down, only 55% said it was a bad time to buy, and 22% said they thought it was a good time to buy a house.

This makes now a good time to buy a home, because there are less buyers competing for homes than there has been for years, and if the rates do come back down, the competition will increase.

(Shh, our secret)

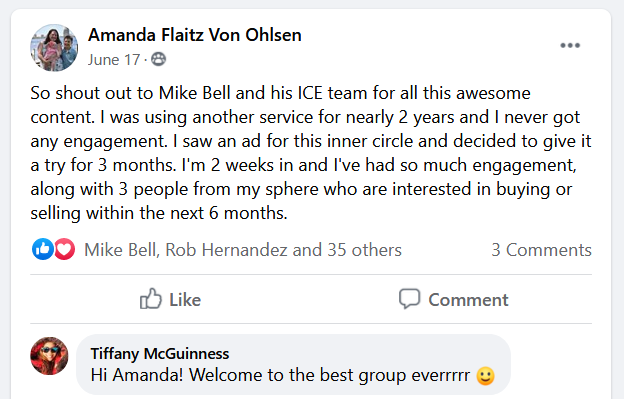

Show your sphere your an expert. We have over 2100 articles covering every real estate topic your audience will love.

Position yourself as a real estate authority!

Real estate + topical events — the perfect match!

Become the bearer of good vibes!

Because hey, everyone loves to laugh!

Get our weekly email that makes communicating with your sphere on social actually enjoyable. Stay informed and entertained, for free.

“Let me know if you or anyone you know is thinking about buying or selling a house in the near future!” Sound familiar? Even if

Being a team leader can be like being a bird bringing back food to feed a nest full of hungry babies. Without you feeding leads

As much as the frantic pace of a “hot” market creates a lot of headlines and excitement, they’re not actually the best of times for

Raise your hand if you’ve at least mentally made a resolution to sell more houses in the coming year. Every year is a clean slate

Crazy title for an article, right? I know. Stick with me, though. I promise this isn’t some sort of “clickbait.” There’s a powerful message if

Depending on your situation, it may not take the full 30 minutes.

This reset password link has expired. Check the latest email sent to you.