Agents: Stop Sending Boring Postcards… Send Ones Like THESE! (18 examples)

Question: Have you seen the postcards most agents send out? BOOOR-ING! I’m pretty sure they make the prospects sleep-walk on their way back inside the

Whether you’ve been planning on buying a house in the near future or not, you’ve probably heard that people with higher credit scores are now paying higher fees, and people with lower credit scores are paying lower fees when getting a mortgage.

Hearing that might make you feel one of two ways if you’re planning on buying a house:

Regardless of which group you’re in, those are both valid feelings and perspectives to have.

It’s an uphill battle when you have a low credit score because you’re just starting out, you’ve fallen on tough times, or just struggled financially. Everything seems to cost you more when you could use a break more than anyone.

Credit card payments are hard to keep up with because your interest rate is so high, you find yourself just paying the minimum amount per month. Your car loan probably has a higher interest rate. And if you want to buy a house, you’re probably going to pay a higher rate than people with a better credit score on the biggest and longest term loan you’ll take on in your life. So yeah, this probably sounds like great news to you.

On the other hand, it’s aggravating to hear that you’re now going to be charged more after being conscientious, careful, and working hard to maintain a high credit score. You might have even done some deliberate things to improve your credit, like take a course, hire a finance coach, or simply read some books on how to do it.

Most likely you haven’t missed any payments on your credit cards, car loans, rent, or mortgages. You’ve proven you’re responsible and less of a risk to a lender because you do what needs to be done to pay your bills in a timely manner. So nobody’s going to fault you for feeling like you’re not being rewarded for your efforts, but rather penalized for it.

Either way, it’s easy to start feeling like there’s no reason to worry about improving and maintaining your credit score.

There’s a lot of debate about this new fee structure, but regardless of whether you’re in favor of the rule or not, there’s not much you can do to change it. So before you decide to just let your credit score slide, or not make efforts to improve or maintain it, consider these four reasons why you should still try to have the highest credit score possible:

The Takeaway:

A new fee structure went into effect on May 1, 2023 that reduced the mortgage fees for home buyers with lower credit scores, while increasing them for buyers with higher credit scores.

Regardless of whether or not you have a high credit score, or a low one, it might make you feel like you don’t need to care about improving or maintaining as high of a credit score as possible.

But you should care because having a lower credit score will still cost you more when you get a mortgage than it does for those with a higher credit score, and on other types of loans and credit you might obtain. Besides, this only applies to mortgages being bought and guaranteed by the Federal Housing Finance Agency, and there’s no guarantee that this fee structure will be in place forever.

(Shh, our secret)

Show your sphere your an expert. We have over 2100 articles covering every real estate topic your audience will love.

Position yourself as a real estate authority!

Real estate + topical events — the perfect match!

Become the bearer of good vibes!

Because hey, everyone loves to laugh!

Get our weekly email that makes communicating with your sphere on social actually enjoyable. Stay informed and entertained, for free.

Question: Have you seen the postcards most agents send out? BOOOR-ING! I’m pretty sure they make the prospects sleep-walk on their way back inside the

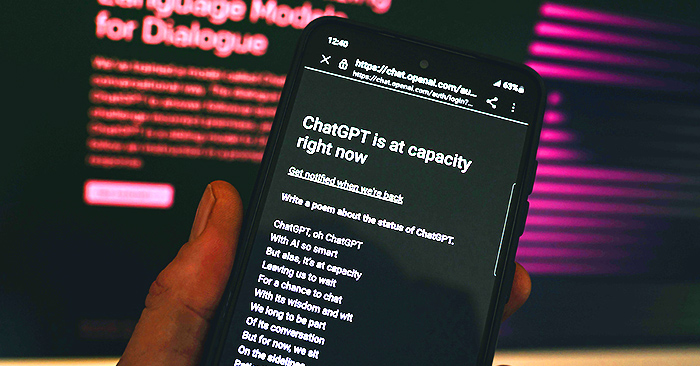

First and foremost, no, this article wasn’t written using artificial intelligence. Or does that sound exactly like something AI would say to throw you off

The other day, I stumbled across a video being hyped as the sickest snowboard clip ever captured. I have zero interest in snowboarding, but the

Blogging is something many real estate agents struggle with. To begin with, you might wrestle with whether or not it’s even worth doing. Is blogging

When you’re in the middle of working with a client, you’re touching base with them constantly. You can actually get pretty close to them, and

Depending on your situation, it may not take the full 30 minutes.

This reset password link has expired. Check the latest email sent to you.